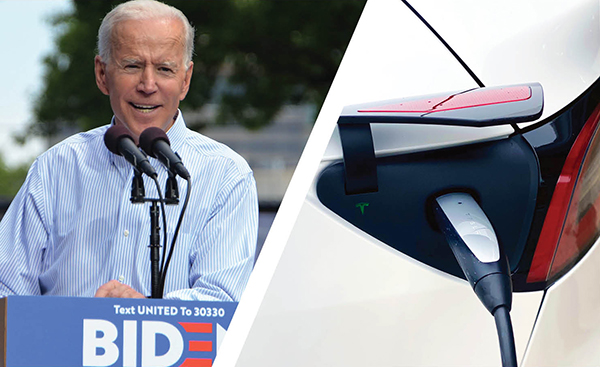

The Buy American provisions of the Inflation Reduction Act and Bipartisan Infrastructure Law have been the topic of much speculation and more than a little controversy. Now the Biden Administration has issued a set of rules for determining which foreign entities of concern (FEOC) are not eligible for EV-related tax credits and other subsidies.

The definition used by the Treasury Department will be used to determine which projects will be eligible for a share of the $6 billion in battery manufacturing grants authorized under the BIL, and which vehicles qualify for a full or partial share of the IRA’s $7,500 tax credit for EV purchases. Beginning in 2025, eligibility will be restricted if the battery contains either components or critical minerals from an FEOC.

“We’re talking about companies under the control or jurisdiction of the government of a ‘covered nation,’ which in this instance means North Korea, China, Russia or Iran,” Deputy Energy Secretary David Turk told reporters.

From the layman’s perspective, we might say that things have progressed from being as clear as mud to being as clear as tea. To determine if any particular project or vehicle is eligible for subsidies, companies may need to wade through the DOE’s proposed guidance and request for public comment, the IRS’s Revenue Procedure 2023-38, and perhaps the Treasury Department’s Notice of Proposed Rulemaking.

What’s certain is that, once the rules take effect, eligibility for subsidies will be restricted for anything sourced from China.

When it comes to the Section 30D credits for EV purchases, the IRS says: “Vehicles placed in service beginning in 2024 must not have batteries containing battery components manufactured or assembled by a FEOC. In addition, vehicles placed in service beginning in 2025 must have not batteries containing applicable critical minerals extracted, processed, or recycled by a FEOC.”

Industry experts expect the news to turbocharge the trend towards establishing domestic sources of critical materials.

“The proposed guidance will provide clarity and certainty to the US automakers, battery manufacturers and producers of critical minerals. It will encourage these industries to invest in diversified and resilient critical mineral and battery supply chains,” White House Renewable Energy Adviser John Podesta said. “And it’ll support good-paying U.S. jobs…paving the way for an electric transportation future that’s built here in America.”

buy generic lasuna – diarex pills purchase himcolin without prescription

besifloxacin generic – sildamax where to buy sildamax for sale

buy generic neurontin 600mg – ibuprofen sale buy azulfidine 500 mg online cheap

buy benemid pills – order tegretol 400mg generic buy carbamazepine 200mg pills

celecoxib 100mg generic – cheap generic urispas indomethacin cost

diclofenac sale – aspirin 75 mg over the counter where can i buy aspirin

purchase rumalaya online cheap – cheap rumalaya amitriptyline 50mg without prescription

pyridostigmine oral – pyridostigmine 60 mg sale azathioprine pills

baclofen us – order feldene 20 mg online cheap piroxicam 20 mg price

order diclofenac for sale – order nimodipine without prescription purchase nimotop sale

cyproheptadine price – zanaflex without prescription generic zanaflex

buy mobic generic – rizatriptan drug ketorolac canada

buy omnicef 300 mg pills – cleocin for sale online buy generic clindamycin for sale

artane online buy – order voltaren gel online where can i buy voltaren gel

cheap accutane – buy dapsone 100 mg pills buy deltasone 5mg online cheap

order deltasone 5mg sale – elimite sale purchase zovirax for sale

order generic betnovate 20 gm – betamethasone medication monobenzone for sale

cost metronidazole 400mg – buy cenforce without a prescription purchase cenforce sale

buy amoxiclav pills – cheap augmentin 1000mg synthroid online

purchase losartan generic – losartan 50mg sale cephalexin order online

buy cleocin online cheap – buy clindamycin generic buy indomethacin 50mg sale

eurax for sale – crotamiton sale buy generic aczone for sale

buy modafinil 200mg pill – buy meloset without prescription meloset drug

bupropion without prescription – shuddha guggulu drug shuddha guggulu pills

buy cheap capecitabine – order mefenamic acid generic brand danazol 100 mg

buy progesterone 100mg for sale – buy ponstel generic buy fertomid sale

buy aygestin without prescription – buy careprost tablets buy yasmin medication

order estrace pills – buy ginette 35 generic purchase anastrozole pill

гѓ—гѓ¬гѓ‰гѓ‹гѓігЃ®иіје…Ґ – г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓі – 500mg г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓі е‰ЇдЅњз”Ё

バイアグラ処方 – バイアグラジェネリック йЂљиІ© г‚·г‚ўгѓЄг‚№йЂљиІ©

гѓ—гѓ¬гѓ‰гѓ‹гѓі гЃЉгЃ™гЃ™г‚Ѓ – г‚ўг‚гѓҐгѓ†г‚¤гѓійЊ 40 mg еј·гЃ• г‚ўг‚ュテインジェネリック йЂљиІ©

valif online lad – buy secnidazole no prescription buy sinemet 20mg without prescription

valif online ridiculous – valif piece buy sinemet 10mg generic

oral indinavir – how to purchase diclofenac gel diclofenac gel where to order

order provigil for sale – purchase combivir pill epivir pills

phenergan without prescription – order lincocin online buy lincocin 500 mg

buy ivermectin canada – buy ivermectin 12mg online order carbamazepine online