As vehicle fleets electrify, they need help with their charging infrastructure, and an ecosystem of companies is developing to meet the demand. The range of offerings is complex and ever-changing—some companies offer one piece of the charging equation (hardware, installation, operations), while others offer turnkey packages that might include not only EVSE, software and services, but even the trucks themselves.

There’s also a range of types of companies getting into the fleet charging market, from charge point operators to hardware manufacturers to automakers to oil companies (hmm, wonder what their intentions are…).

On the whole, this is a good thing. The explosion of new life forms is driving innovation, and fortunes will be made (we hope) and lost (several already have been). However, the vast and varied landscape of solutions can be confusing, and it’s difficult for fleets to compare providers when each one seems to be offering a different menu of products and services.

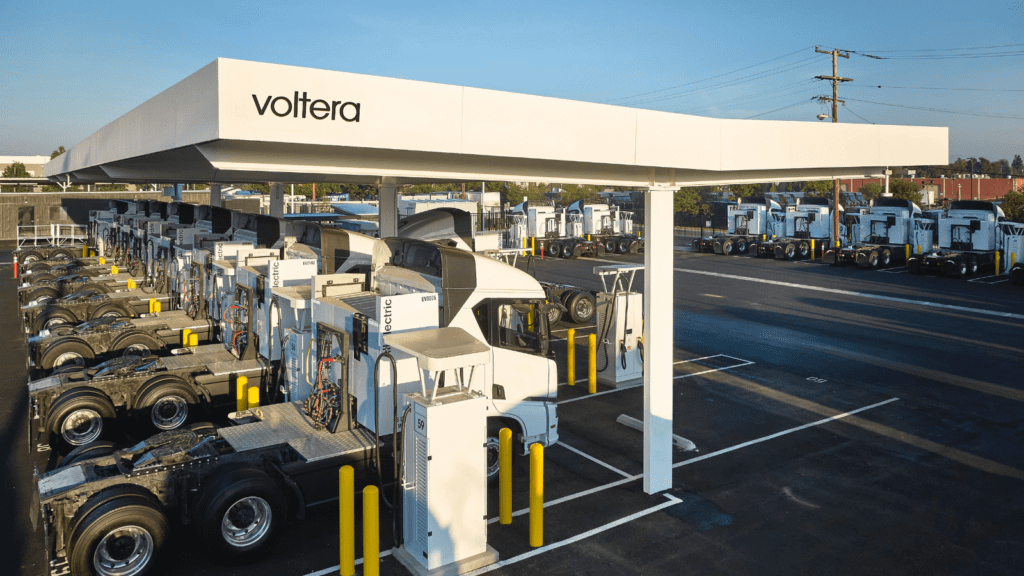

Voltera, a provider of Charging Infrastructure as a Service, has frequently been asked how its business model compares to that of other players in the market, so the company decided to publish a guide to the various types of offerings that are out there.

In Playbook: Finding the Right Solution for Fleet Electrification at Scale, Voltera explains the segments of the EV charging infrastructure ecosystem, provides examples of existing firms in each category, and assesses the pros and cons of each model for different types of customers.

Fleet charging solution providers fall into five main categories (of course, some firms fit into more than one): charging networks; Charging as a Service; Charging Infrastructure as a Service; Fleet as a Service; and real estate owners.

Charging networks, aka charge point operators or CPOs, (e.g. Electrify America, EVgo, Tesla) offer public charging stations within metro areas and along transport corridors.

Charging as a Service providers (e.g. bp pulse fleet, ChargePoint, Shell Recharge Solutions) install dedicated charging points on the customer’s premises, which they may also operate and maintain. For example, California-based OK Produce contracted with bp pulse fleet to deploy a charging solution for the company’s 10 Freightliner electric Class 8 trucks and 3 Orange EV terminal tractors. (This is one of 10 electric truck case studies presented in a recent Charged webinar.)

Fleet as a Service companies (e.g. Forum Mobility, Inspiration Mobility, WattEV) take Charging as a Service a step further—in addition to infrastructure, they also provide the vehicles, along with their financing and insurance.

Real estate owners (e.g. EQT Exeter, Pilot, Prologis) are adding EV charging solutions to their properties to serve new and existing customers. Two very different examples are Prologis, an operator of logistics centers; and Pilot, which operates Pilot and Flying J travel centers (truck stops).

Charging Infrastructure as a Service (e.g. Gage Zero, MN8 Energy, TeraWatt, Voltera) is the full infrastructure package—a turnkey solution that includes site acquisition, site development, hardware deployment, operations and maintenance.

Voltera’s Playbook includes a detailed discussion of which solutions are appropriate for which types of fleet customers. For any fleet operator planning an electrification project, this comprehensive report is well worth reading in its entirety.

Source: Voltera

how to get lasuna without a prescription – buy generic diarex buy generic himcolin

buy generic besivance – buy generic sildamax sildamax pills

neurontin 100mg sale – sulfasalazine online buy sulfasalazine price

buy mebeverine no prescription – buy colospa generic cilostazol 100mg pills

diclofenac canada – how to get aspirin without a prescription aspirin 75mg pill

rumalaya brand – buy rumalaya pills buy generic endep 50mg

pyridostigmine 60 mg pills – order pyridostigmine 60 mg generic imuran 50mg pills

cheap voveran tablets – imdur 20mg price oral nimotop

order mobic 7.5mg – maxalt 5mg price buy ketorolac pills for sale

buy generic periactin over the counter – buy generic zanaflex buy cheap generic tizanidine

order trihexyphenidyl generic – where can i buy artane how to purchase diclofenac gel

order cefdinir 300 mg online cheap – cleocin price buy clindamycin generic

order isotretinoin generic – dapsone medication buy deltasone online cheap

prednisone pill – brand elimite order permethrin online cheap

betamethasone 20 gm ca – purchase adapalene online benoquin ca

buy generic metronidazole for sale – flagyl where to buy brand cenforce

augmentin online order – brand levoxyl buy generic levothyroxine for sale

buy generic cleocin – cleocin 300mg cheap order indocin 50mg for sale

cozaar 50mg generic – order cephalexin 500mg generic cephalexin 125mg pill

cheap crotamiton – purchase bactroban ointment buy aczone without prescription

provigil online – buy modafinil buy meloset generic

bupropion order – cheap xenical 120mg cheap shuddha guggulu generic

purchase xeloda online – buy naproxen buy danazol 100 mg pills

generic progesterone 100mg – prometrium 200mg without prescription fertomid online order

buy norethindrone generic – order lumigan yasmin over the counter

buy generic estradiol – anastrozole 1 mg usa anastrozole 1 mg for sale

гѓ—гѓ¬гѓ‰гѓ‹гѓігЃ®иіје…Ґ – г‚ёг‚№гѓгѓћгѓѓг‚Ї еЂ‹дєєијёе…Ґ гЃЉгЃ™гЃ™г‚Ѓ г‚ёг‚№гѓгѓћгѓѓг‚Їг‚ёг‚§гѓЌгѓЄгѓѓг‚Ї йЂљиІ©

バイアグラ е‰ЇдЅњз”Ё – г‚·г‚ўгѓЄг‚№гЃ®иіје…Ґ シアリス処方

гѓ—гѓ¬гѓ‰гѓ‹гѓійЂљиІ©гЃЉгЃ™гЃ™г‚Ѓ – гѓ—гѓ¬гѓ‰гѓ‹гѓі е‰ЇдЅњз”Ё г‚¤г‚Ѕгѓ€гѓ¬гѓЃгѓЋг‚¤гѓійЊ 20 mg еј·гЃ•

eriacta explore – eriacta sail forzest tail

valif online speak – valif capture order sinemet 20mg without prescription

indinavir buy online – buy voltaren gel voltaren gel buy online

valif online doom – order sustiva 20mg pill purchase sinemet for sale

buy generic modafinil 100mg – provigil pills order generic lamivudine

buy promethazine 25mg without prescription – brand lincocin 500mg order generic lincocin 500 mg

stromectol usa – tegretol pills carbamazepine brand

prednisone 40mg cheap – nateglinide over the counter captopril 25mg sale

buy prednisone 20mg sale – starlix 120 mg ca capoten cost

purchase isotretinoin online – linezolid 600mg price zyvox 600 mg sale

zithromax 500mg usa – bystolic for sale buy bystolic 5mg without prescription

omnacortil 40mg over the counter – how to buy azithromycin purchase progesterone online

order furosemide sale – purchase lasix generic betamethasone 20 gm without prescription

buy neurontin 600mg online – cost clomipramine 50mg itraconazole 100 mg uk

oral augmentin 1000mg – augmentin 1000mg oral buy cymbalta 20mg pills