Tesla (NASDAQ: TSLA) stock has experienced a slight pullback in the last few weeks, tanking to losses that equate to just under 16% since the beginning of 2021. Wedbush analyst Dan Ives believes the pullback is temporary, and that Tesla could still bring a reward to investors who stand by the automaker’s stock through 2021, as demand, especially in China, may pave the way for the elusive $1 trillion market capitalization.

Already owning the title as the World’s Most Valuable Automaker, Tesla’s meteoric rise on Wall Street was fueled by the ability to overcome adversity in a challenging economic climate in 2020 thanks to the COVID-19 pandemic. Furthermore, a year that saw the automotive industry decline as a whole didn’t treat Tesla the same way, as the electric car company managed to outperform itself once again, marking 2020 as its best year in company history.

The beginning of 2021 has seen a different tune to Tesla’s performance on Wall Street. Investors have been spoiled with hand-over-fist gains in 2020, but a Q4 2020 Earnings Call that didn’t outline the company’s goals for the 2021 fiscal year left some analysts feeling unsatisfied and unsure about the company’s goals for the year.

While Tesla didn’t give a specific figure, as last year it outlined a goal of 500,000 deliveries, which it came close to at 499,550 for the year, Elon Musk and Co. did outline targets for growth in a percentage factor, indicating that it expects “to achieve 50% average annual growth in vehicle deliveries. In some years we may grow faster, which we expect to be the case in 2021.”

Ives, a Wedbush analyst who has been bullish on Tesla, believes a million vehicles could be delivered by next year, with China being the main supplier of the company’s momentum in the coming years.

Ives wrote in a note to investors (via Financial Review):

“We believe China could see eye-popping demand into 2021 and 2022 across the board with Tesla’s flagship Giga 3 footprint a major competitive advantage, as domestic players such as BYD, Nio, Xpeng, and Li also are also firing on all cylinders and just scratching the surface of the overall TAM in China…If China stays on its current path for Tesla, Musk & Co. could hit one million delivery units globally by 2022. This speaks to our thesis that Tesla will hit a trillion-dollar market cap in 2021 despite this risk-off moment for EV stocks with the bears coming back to life after a long hibernation in their caves over the past year.”

At 1:45 PM EST, Tesla’s market cap sat at $590.06 billion, and shares were trading at $610.02.

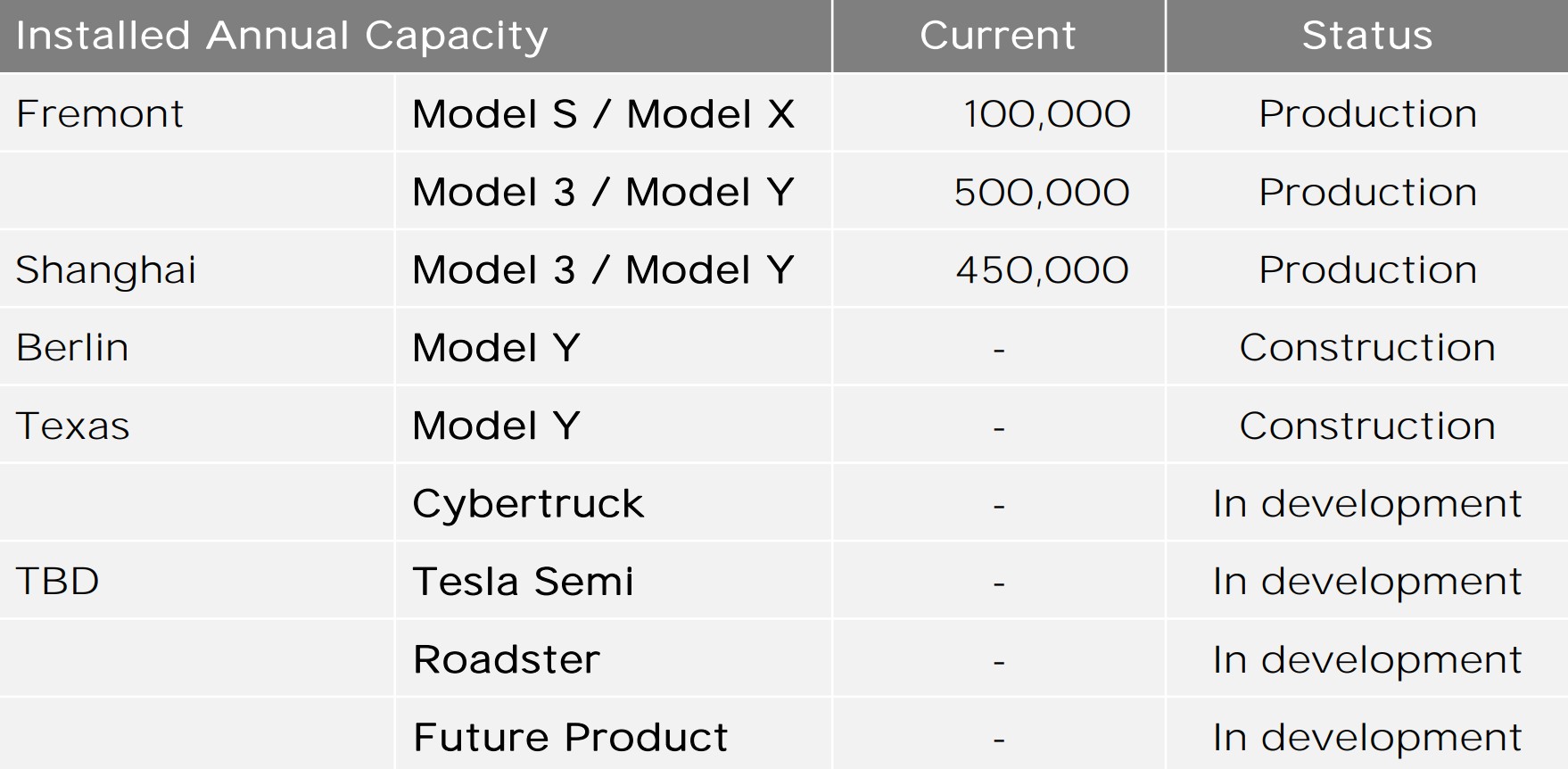

The company’s current delivery output projections, which combine the total yearly output of its currently-active plants, would put the company at a forecasted 1,050,000 production rate for 2021. Deliveries would be within a few percentage points of that, as the company does not typically hold inventory.

Credit: Tesla

Outlook for 2021, according to Ives, seems to point toward quickly accelerating demand and expansion in China, where Tesla has been extremely competitive. Only one vehicle has managed to outsell the Tesla Model 3 in China: a GM-produced car called the Wuling HongGuang Mini EV, which doesn’t compete with any of Tesla’s cars in terms of range or performance.

As for the rest of the industry, Wedbush doesn’t believe the surge is anywhere from over. An extremely young and new sector in the grand scheme of things, the EV industry is influencing mass change within legacy automakers, who are being forced to adapt to the changing sector. “Our answer is emphatically that the EV party and transformation is just beginning as this industry is on the cusp of a $US5 trillion ($6.4 trillion) market opportunity over the next decade,” Wedbush said.

Disclosure: Joey Klender is a TSLA Shareholder.

buy lasuna for sale – order diarex without prescription himcolin for sale

gabapentin 600mg cheap – ibuprofen tablet azulfidine 500mg canada

probenecid 500mg tablet – order tegretol 400mg sale buy carbamazepine 400mg pill

celecoxib 200mg for sale – order celecoxib 100mg online cheap buy indomethacin pill

colospa canada – buy mebeverine 135 mg online where can i buy pletal

purchase cambia sale – aspirin over the counter aspirin oral

rumalaya order online – shallaki for sale online order amitriptyline 50mg without prescription

buy mestinon 60 mg for sale – imitrex 25mg over the counter buy imuran pills for sale

ozobax usa – feldene for sale online feldene 20 mg canada

buy periactin without a prescription – buy tizanidine without prescription buy generic tizanidine online

trihexyphenidyl cheap – buy trihexyphenidyl medication purchase cheap emulgel

order generic cefdinir 300mg – cleocin medication

order prednisone online – order prednisone 5mg pill order zovirax

buy acticin paypal – buy acticin generic retin without prescription

order generic betnovate – adapalene ca purchase monobenzone online cheap

buy cheap flagyl – metronidazole medication order cenforce 50mg online cheap

augmentin 1000mg without prescription – buy synthroid 100mcg order synthroid 100mcg without prescription

buy cleocin 300mg without prescription – order indomethacin 50mg pill where to buy indomethacin without a prescription

buy cozaar 25mg generic – keflex pills keflex us

buy generic eurax over the counter – order generic bactroban ointment aczone gel

modafinil 200mg tablet – melatonin 3 mg cost order melatonin online cheap

bupropion price – purchase orlistat without prescription shuddha guggulu cost

prometrium 200mg ca – order clomid for sale buy fertomid generic

aygestin 5 mg us – buy aygestin 5 mg online buy yasmin pills for sale

dostinex pills – buy cabgolin without prescription buy alesse pills for sale

yasmin uk – buy anastrozole without prescription anastrozole 1 mg cost

valif pills under – sinemet 20mg pills order sinemet 10mg pill

buy modafinil 200mg pills – epivir cheap combivir order online

buy ivermectin stromectol – carbamazepine order online purchase carbamazepine online

deltasone 40mg pills – oral nateglinide 120mg buy capoten without prescription

deltasone 20mg brand – starlix where to buy order capoten without prescription

accutane 20mg cheap – decadron pill order linezolid pills

zithromax 250mg generic – cheap tindamax buy nebivolol 20mg without prescription

buy omnacortil no prescription – cheap prednisolone for sale brand progesterone 200mg