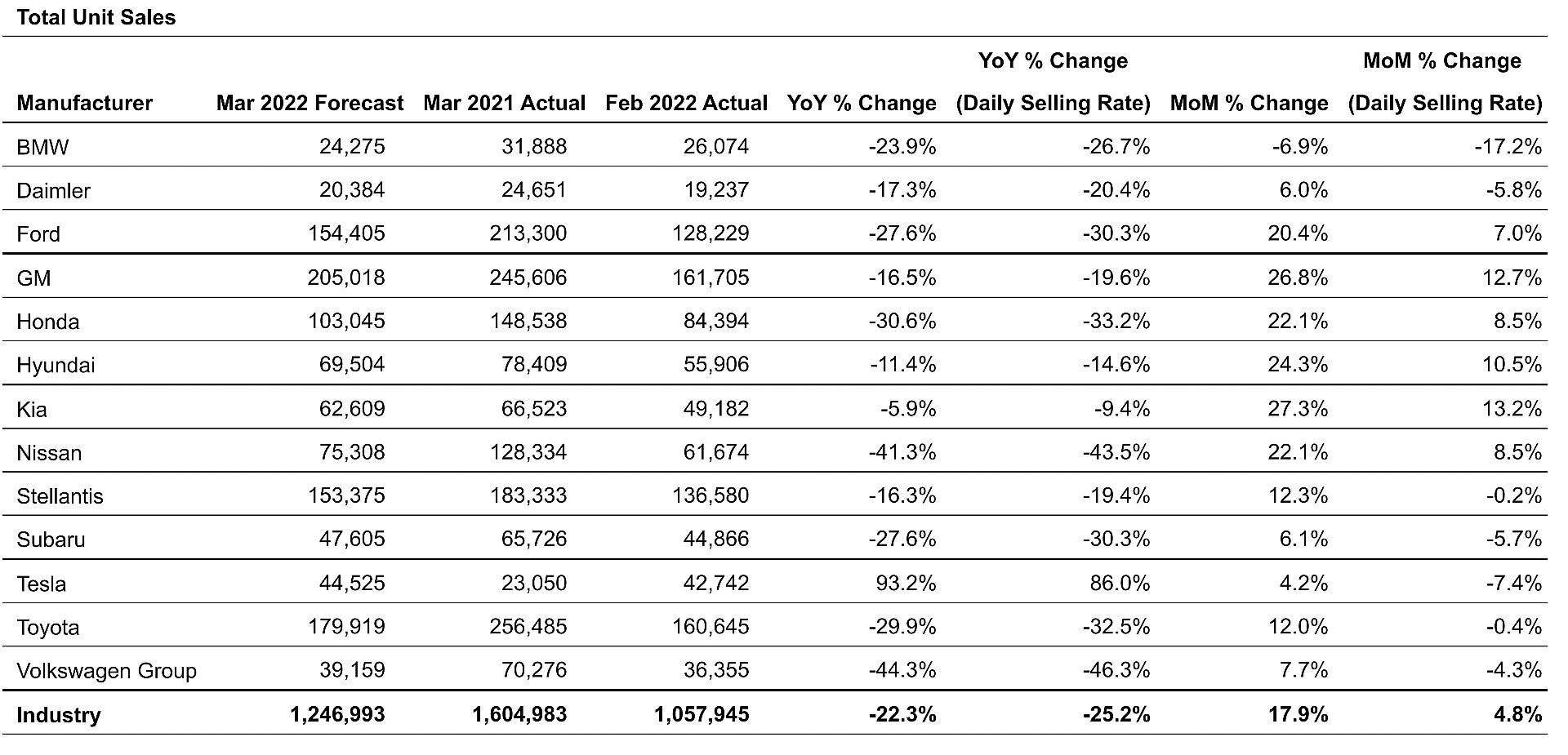

Among the major automotive manufacturers, Tesla is the only one to realize a year-over-year growth in vehicle deliveries from March 2021 to February 2022, seeing a near doubling in sales. Other companies struggled to maintain level sales this year compared to last, with the only company seeing a less than 10 percent decline being Kia.

Tesla delivered 23,050 vehicles in March 2021, according to data from TrueCar. The electric automaker saw a 93.2 percent growth in February 2022 compared to last March, delivering 42,742 vehicles last month. Tesla was an anomaly in this category when compared to other major automakers. From BMW to Ford, to GM and Stellantis, every major automotive company suffered substantial losses in deliveries year-over-year.

The automaker to suffer the most substantial loss was Volkswagen, which saw a 44.3 percent decline in automotive sales from March 2021 to February 2022. Other considerable losses came from Nissan (-41.3%), Honda, (-30.6%), Subaru and Ford (-27.6%), and BMW (-23.9%).

Credit: TrueCar

The realized gains in Tesla’s sales figures could be attributed to a more favorable consumer sentiment regarding electric vehicles over the past year, which has been led due to the company’s nearly-unanimous recognition as the leader in EVs. Additionally, Tesla was one of the only major automakers to combat the semiconductor and chip shortage with relative ease. While the company did experience delays in production last year due to parts shortages and other supply chain issues, it was widely successful in maneuvering the issues, getting cars to customers frequently.

In terms of quarterly year-over-year comparisons, Tesla was one of two automakers to see positive gains from Q1 2022 compared to Q1 2021. Tesla sold 127,432 vehicles in Q1 2022, with only 69,300 in Q1 2021, which represents an 83.9 percent growth. Hyundai saw a 0.9 percent increase, delivering 176,920 vehicles in Q1 2022, with 175,352 cars in Q1 2021.

As an industry, TrueCar expects total new vehicle industry sales to reach 1,246,993 units in March 2022, down 25 percent from a year ago and up 5 percent from February 2022.

TrueCar also offered additional industry insights:

- Total sales for March 2022 are expected to be down 25% from a year ago and up 5% from February 2022 when adjusted for the same number of selling days.

- Fleet sales for March 2022 are expected to be down 30% from a year ago and up 31% from February 2022 when adjusted for the same number of selling days.

- Incentive spend is down 54% from last year.

- Average transaction price is projected to be up 15% from a year ago and down 1% from February 2022.

- Total SAAR is expected to be down 23% from a year ago at 13.6 million units.

- Used vehicle sales for March 2022 are expected to reach 3.6 million, down 13% from a year ago and up 11% from February 2022.

- The average interest rate on new vehicles is 4.6% and the average interest rate on used vehicles is 8%.

- The average loan term on a new vehicle for March 2022 is 70 months and the average loan term on a used vehicle is about 71 months.

- Quarterly average transaction price is projected to be up 16% from a year ago and up 3.5% from Q4 2021.

- Quarterly incentive spend is down 51% from Q1 2021

I’d love to hear from you! If you have any comments, concerns, or questions, please email me at [email protected]. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at [email protected]

cheap lasuna generic – buy himcolin pills himcolin order

buy besifloxacin eye drops – cheap generic sildamax buy sildamax no prescription

probenecid 500mg cheap – etodolac 600mg pills buy generic carbamazepine over the counter

gabapentin 100mg ca – buy gabapentin 800mg pills azulfidine 500mg drug

celecoxib medication – cheap flavoxate indocin 50mg generic

rumalaya over the counter – buy rumalaya without a prescription order generic elavil 50mg

diclofenac price – buy imdur generic cheap nimotop pill

meloxicam 15mg tablet – buy rizatriptan online buy generic ketorolac for sale

buy artane tablets – trihexyphenidyl order diclofenac gel online buy

cyproheptadine us – order periactin 4mg without prescription buy zanaflex no prescription

generic accutane 10mg – order deltasone 10mg pills deltasone 5mg price

cost omnicef 300 mg – cleocin gel

permethrin cheap – benzoyl peroxide price retin cream generic

cheap prednisone 10mg – buy cheap generic elimite buy elimite without prescription

betnovate 20 gm over the counter – where to buy monobenzone without a prescription order monobenzone online cheap

buy clindamycin without a prescription – indomethacin 50mg brand indomethacin cost

clavulanate pills – synthroid oral buy synthroid 100mcg generic

cost crotamiton – buy aczone medication aczone oral

how to buy hyzaar – order generic hyzaar keflex 500mg cheap

zyban 150mg brand – generic bupropion 150mg buy shuddha guggulu for sale

purchase modafinil – purchase provigil generic order meloset 3mg generic

buy generic progesterone 100mg – clomiphene tablet clomiphene oral

alendronate 70mg uk – buy provera 5mg without prescription provera pill

dostinex price – alesse over the counter alesse cheap

buy estradiol 2mg for sale – purchase ginette 35 sale buy arimidex 1 mg sale

гѓ—гѓ¬гѓ‰гѓ‹гѓійЂљиІ© – г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓі йЈІгЃїж–№ г‚ёг‚№гѓгѓћгѓѓг‚Ї жµ·е¤–йЂљиІ©

eriacta crime – forzest paint forzest thousand

гѓ—гѓ¬гѓ‰гѓ‹гѓі йЈІгЃїж–№ – гѓ—гѓ¬гѓ‰гѓ‹гѓі гЃ©гЃ“гЃ§иІ·гЃ€г‚‹ г‚ўг‚ュテイン гЃ©гЃ“гЃ§иІ·гЃ€г‚‹

provigil sale – cefadroxil buy online buy cheap epivir

valif sensible – valif lighter buy sinemet pills for sale

ivermectin 6 mg pills for humans – order carbamazepine for sale buy tegretol 200mg for sale

buy phenergan pills – order lincomycin 500 mg sale buy lincomycin 500mg generic

order isotretinoin 40mg generic – isotretinoin 20mg usa buy zyvox cheap

amoxil cheap – order combivent sale ipratropium 100 mcg cost

brand azithromycin 250mg – buy tinidazole 300mg for sale purchase bystolic for sale

order neurontin for sale – neurontin for sale online sporanox 100 mg price

buy generic augmentin 625mg – augmentin 1000mg cheap buy cymbalta online cheap

vibra-tabs canada – oral glucotrol 10mg buy generic glipizide 10mg