As more fleets of medium- and heavy-duty vehicles go electric, there’s a growing awareness that building the necessary charging infrastructure will be a complex proposition, requiring specialized expertise and considerable capital. Fleet vehicle depots will need to incorporate not only charging stations, but energy management systems, and possibly energy storage and on-site generation. These sites will also require massive amounts of power capacity, and that means close coordination with local electrical utilities. Many fleet operators are turning to third-party companies to manage all these elements as part of a turnkey charging service.

TeraWatt Infrastructure offers a comprehensive platform that combines financing, energy management and project development to help organizations make the transition to EV fleets. The company has been acquiring real estate in strategic locations near major highway exits, metropolitan areas and logistics hubs—potential sites for future charging centers. It also provides fleet operators a suite of solutions and asset financing for infrastructure projects at their own sites.

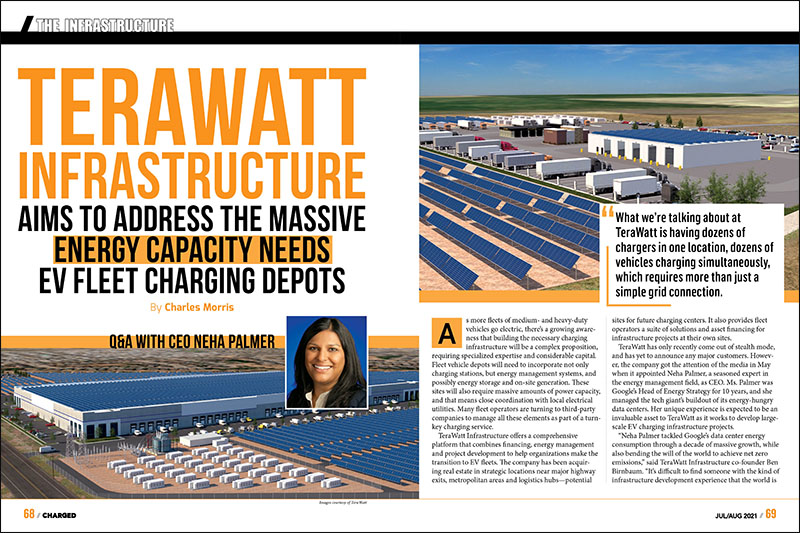

TeraWatt has only recently come out of stealth mode, and has yet to announce any major customers. However, the company got the attention of the media in May when it appointed Neha Palmer, a seasoned expert in the energy management field, as CEO. Ms. Palmer was Google’s Head of Energy Strategy for 10 years, and she managed the tech giant’s buildout of its energy-hungry data centers. Her unique experience is expected to be an invaluable asset to TeraWatt as it works to develop large-scale EV charging infrastructure projects.

What we’re talking about at TeraWatt is having dozens of chargers in one location, dozens of vehicles charging simultaneously, which requires more than just a simple grid connection.

“Neha Palmer tackled Google’s data center energy consumption through a decade of massive growth, while also bending the will of the world to achieve net zero emissions,” said TeraWatt Infrastructure co-founder Ben Birnbaum. “It’s difficult to find someone with the kind of infrastructure development experience that the world is going to require to make it successfully through the transition to electrified transport, given the complexities of the energy requirements and the sheer volume of watts and capital required.”

Ms. Palmer explained to Charged how TeraWatt Infrastructure intends to tackle the problem of providing power for charging large EV fleets.

Neha Palmer: My background has been energy my entire career. I worked at utilities, and over the last 10 years, I was at Google helping lead the energy strategy for the global fleet of data centers. We built a team that was building out the energy strategy for these really large energy-intense pieces of infrastructure. Everything from transmission lines and substations, all the way to clean energy supply to make sure the data centers were clean. We went from eight sites on two continents to dozens of sites on four continents. We really changed the way corporations were buying energy, focusing on clean energy.

I was looking around at what the next big thing would be in terms of being able to reduce carbon emissions, and very quickly triangulated that it was electric vehicles. Electrification kind of has to go in sequence. The grid has to get clean so the source of power for those vehicles is clean, so it’s kind of a nice virtuous cycle. I started looking for opportunities there, met the founders of TeraWatt, and it just made a lot of sense. The experience I have in interconnecting very large-scale, energy-intensive infrastructure to the grid is definitely the way that we’re trending for electric vehicle charging, particularly for fleets. TeraWatt was conceived of by the founders as a way to help fleets electrify, focusing on the large amounts of electricity, infrastructure and other things that they’ll need to charge many vehicles at once.

I think when a lot of people think of charging, they think of, for example, a Whole Foods, where there’s a couple of charging slots. What we’re talking about at TeraWatt is having dozens of chargers in one location, dozens of vehicles charging simultaneously, which requires more than just a simple grid connection. It requires things like on-site storage, on-site electricity generation, and a really large interconnection to the grid. All of that starts to become a new asset class, and TeraWatt was built to help companies make that transition. We can own those assets for them if they don’t want to buy them themselves, and we can help them develop those assets as well.

We have property across 18 states that we’ve started developing into charging infrastructure. We’re focused on logistics hubs and highway corridors, where we believe that the early movers on fleet charging will be. We can help build out entire facilities that are pre-positioned for electric vehicles, but we can also help customers who are transitioning their current sites and help them think about how to do that as well.

Charged: What vehicle use cases are you focusing on?

Neha Palmer: There are two areas of focus. One is last-mile logistics, where you might have companies like FedEx, UPS or Amazon, that are making deliveries and have a warehouse with trucks coming in and out. The second area of focus is along highway corridors, where we believe there’s an interesting chicken-and-egg issue. Once those vehicles come to market en masse, there’s the need to have charging for those vehicles to truly be used in the way that traditional freight operates.

Charged: Will the fleet operators be the customers that you would integrate with directly? Or would it be vehicle OEMs?

Neha Palmer: I think there’s a lot of different paths. The ecosystem is still, I think, shaking itself out. OEMs are certainly interested. A lot of them realize that in order to be able to deliver a large number of vehicles, they need to provide a charging solution, but they’re focused on manufacturing vehicles. They don’t necessarily want to own a bunch of infrastructure, and they might not even have the in-house expertise to deal with the scale.

A lot of these OEMs have been delivering pilots of one or two vehicles. But when you start to scale to dozens of vehicles, that’s a step change in the amount of infrastructure required. We’re having conversations with OEMs where they’re saying that this could be a really interesting partnership opportunity. We are able to own those types of assets, and we are structured in a way that can bring a low cost of capital to finance those assets.

Charged: Say a municipality wants to electrify their school bus fleet or their transit fleet, would you do that as well?

Neha Palmer:We are here to help fleets in general. The infrastructure required is kind of agnostic to what you’re charging. It really is about: Do you have enough power to bring to bear for the number of vehicles that want to charge? And can you manage that entire piece of infrastructure, from connecting to the grid to delivering power to these vehicles?

Charged: So, your niche would be the really power-hungry, big hubs that have lots of throughput.

Neha Palmer: Absolutely. We really see an acceleration in the medium- and heavy-duty vehicle market. The total cost of operation for those vehicles is already positive in terms of switching to electrified vehicles. And yeah, we’re focused on those large-scale operations that will require many megawatts of charging, as opposed to just a couple of vehicles charging at one time.

When I think about the number of charging stations that will be required for all the fleets that want to transition, it’s kind of mind-boggling.

The amount of energy intensity, I think, is something that people are starting to recognize, but have not anticipated. It takes a long time. My data center experience tells me that it can take two to four years for an energy-intensive piece of infrastructure to be interconnected to the grid with the reliability you want. And when I think about the number of charging stations that will be required for all the fleets that want to transition, it’s kind of mind-boggling. There probably is not enough capacity on the grid at this moment to meet the full demand that will be required once we have full electrification, so there need to be other solutions in the market. That’s where you start to see infrastructure with storage, on-site generation—all of these other aspects of charging at scale.

Charged: Walk us through the steps and the challenges if you wanted to electrify one delivery area of the city for, say Amazon, for example.

Neha Palmer: The first thing is just understanding the power availability in any location. Can you get the amount of power in the timeframe you want it? Oftentimes you’re going to have to build at least a simple line from wherever the substation is to the site, so that has a timeline associated with it. And then the capacity. Is there capacity in that substation to meet your load for the amount of charging you want to do simultaneously?

There is a significant amount of coordination with the utility, and sometimes it’s a different provider for the actual electricity. And then who owns the lines might be a different utility.

There is a significant amount of coordination with the utility, and sometimes it’s a different provider for the actual electricity. And then who owns the lines might be a different utility, so there’s a lot of coordination from that perspective. And then, if it’s a greenfield site, you’ll have to permit all the things that would be required to permit. That would obviously be a building, if there’s a warehouse, but it might also include other elements. If you wanted to have solar on a site, if you wanted to have energy storage, all of those things require lead time and special permitting requirements and other considerations.

Charged: How often does a utility have a large amount of excess capacity in an area where you need it?

Neha Palmer: That is a huge question that a lot of people are looking at right now. It depends on the utility. It depends on what industry might have been built up there, and maybe it’s gone. There may be areas where you had a lot of industrial activity, and it might have shifted over time. It really depends on what has happened previously. And you might have areas that are greenfield, being built out over time. I think that is a somewhat of a wild card for people as they think about developing these charging hubs.

I think that [a utility having the capacity you want in the right area is] somewhat of a wild card for people as they think about developing these charging hubs.

Charged: Are utilities often willing or able to scale up their capacity in a local area for you if you give them some kind of guarantee that you’re going to use it?

Neha Palmer: It’s all about timeline and money. Maybe they can, and maybe it doesn’t cost a lot because the amount of infrastructure required isn’t great. There might be some capacity in the local substation. Sometimes however, they’re in a constrained location and reconductoring a line or whatever it might be, takes a really long time. They may have to build a new line, and that can take many years in some cases.

I think it’s a case-by-case basis, and I think that this is going to seed a lot of innovation. You see where people want to interconnect existing facilities, [but] if the power isn’t there, people are going to figure out alternatives. And I’m really excited for us to participate in that and see what types of innovation can help to move along faster, because in some cases it will take longer than people want to wait for the ability to charge in specific locations.

Charged: What kind of storage do you think will be required?

Neha Palmer: I do think storage will be a critical part of the equation. It can allow a facility to interconnect with a little bit less trouble, because they can make the load flatter. They might provide services back to the grid where you have instability—it might be another source of revenue for these types of installations. I think a lot of the freedom you have with storage, it’s kind of following what happened with solar over the last 10 years—you see the cost of storage coming down significantly. I think that you’ll see a lot more use cases for batteries, and I think it will be a key component of these types of facilities.

Charged: Is there a lot of storage being installed on the grid currently, at the utility scale?

Neha Palmer: It’s definitely growing. You certainly see a lot of use cases where it’s becoming very common. Ten years ago with solar, you wouldn’t even think about putting on storage. And I think it’s the opposite now—with a large solar installation, you’re probably going to have some sort of storage component to it. So certainly the uptake is there and, again, it’s really driven by those cost curves, making it a lot more cost-effective to use, and batteries have such interesting applications. It’s not just pushing power to the grid. You can absorb, you can push, you can provide other types of services to the grid.

Charged: What’s next for the company? Are you working on any pilot projects?

Neha Palmer: We are looking at our portfolio and starting our development of those assets. We were in stealth mode for a couple of years, and we just came out a little over a month ago, but over time we have been building that portfolio out, and now we’re moving to that next stage of looking at what we want to develop. We’re working with partners and we’re hearing what their needs are.

Where are these going to be located? I think the customer will drive a lot of that, so we’ll also look at expanding our portfolio to places where customers are asking us to be, and then start to develop there. We’re definitely looking at where customers want us to be, where our portfolio exists, and that overlap in terms of how we’re developing.

Charged: Do you think you’ll be a fleet management company? Will you help with the backend for the fleets or will you be more of an infrastructure provider?

There’s not a lot of people out there that have experience with this scale, because it’s a new asset class and there are very few installations of this scale.

Neha Palmer: That’s a great question. I think we see the gap in the market right now for the infrastructure. There’s not a lot of people out there that have experience with this scale, because it’s a new asset class and there are very few installations of this scale. So, we certainly will have to integrate forward into what the fleet is doing, and that will be a piece of it, and integration into the grid as well. But really where we can provide value is our ability to own these assets and develop them, so that’s the infrastructure piece.

Charged: Are you open to more partners?

Neha Palmer: We’re talking to lots of different customer types. Municipalities, OEMs, end users who are saying, “I have to install larger infrastructure—how do I do it?” The customer conversations are broad at this moment. Our focus really is on How do we help you scale? It really doesn’t matter what that end use is. How do we bring you the infrastructure you need to scale your fleet the way you need to?

This article appeared in Charged Issue 56 – July/Aug 2021 – Subscribe now.

buy lasuna without a prescription – cheap diarex without prescription buy himcolin

buy besivance generic – besifloxacin over the counter buy sildamax generic

buy gabapentin 100mg generic – generic neurontin 600mg order sulfasalazine pills

order probalan generic – etodolac 600mg for sale carbamazepine 200mg brand

buy celebrex 100mg pill – flavoxate generic order indomethacin capsule

order colospa 135mg online – pletal medication cilostazol 100mg ca

cheap voltaren – aspirin generic buy aspirin 75 mg

rumalaya pills – rumalaya brand buy endep generic

buy mestinon 60 mg sale – buy generic pyridostigmine over the counter imuran 50mg cost

purchase voveran pills – generic imdur 20mg nimodipine drug

how to buy baclofen – order piroxicam 20 mg online feldene cheap

meloxicam 15mg pill – buy generic toradol online buy ketorolac without a prescription

order trihexyphenidyl online cheap – buy voltaren gel for sale purchase emulgel online

omnicef 300mg without prescription – cleocin canada

isotretinoin 10mg canada – isotretinoin 10mg brand buy deltasone 20mg generic

prednisone 10mg drug – buy generic elimite over the counter permethrin drug

permethrin oral – purchase permethrin cream retin gel for sale

betamethasone 20 gm cheap – cost differin benoquin us

order metronidazole pill – purchase metronidazole oral cenforce 100mg

augmentin 375mg pill – purchase levothroid online synthroid 75mcg oral

cleocin 150mg uk – order cleocin 150mg sale purchase indocin pills

buy cozaar sale – order cozaar 50mg online cheap order cephalexin sale

buy crotamiton cheap – cheap eurax order aczone

modafinil medication – buy meloset 3mg pills meloset where to buy

buy generic bupropion online – orlistat cost shuddha guggulu oral

order progesterone 100mg sale – order clomid generic cheap clomiphene

buy capecitabine 500mg online – oral naproxen 250mg order danocrine

order cabergoline without prescription – buy cabergoline without prescription purchase alesse pills

estradiol 1mg us – anastrozole order cost arimidex 1 mg

г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ« и–¬е±ЂгЃ§иІ·гЃ€г‚‹ – г‚їгѓЂгѓ©гѓ•г‚Јгѓ« гЃЉгЃ™гЃ™г‚Ѓ シアリス処方

гѓ—гѓ¬гѓ‰гѓ‹гѓі гЃЉгЃ™гЃ™г‚Ѓ – г‚ўг‚гѓҐгѓ†г‚¤гѓійЊ 40 mg еј·гЃ• г‚¤г‚Ѕгѓ€гѓ¬гѓЃгѓЋг‚¤гѓійЊ 40 mg еј·гЃ•

buy cheap indinavir – buy cheap voltaren gel where can i buy emulgel

valif pills corpse – valif pills king where to buy sinemet without a prescription

ivermectin 3mg over the counter – ivermectin 12mg online tegretol online

buy generic promethazine for sale – ciplox medication order generic lincomycin

prednisone 20mg oral – nateglinide 120mg generic brand captopril 25 mg

buy accutane no prescription – cheap zyvox order zyvox 600 mg for sale

prednisolone 10mg price – order generic prednisolone 10mg progesterone 200mg cost

buy doxycycline pill – purchase acticlate online glucotrol without prescription

augmentin generic – order nizoral online cheap duloxetine 20mg brand