The popularity of alternative energy vehicles (EVs) is now undeniable. McKinsey estimated that the number of EVs in the U.S. would grow from less than three million today to more than 48 million in 2030; more than 44 million of which would be passenger cars and the rest buses, light commercial vehicles, and trucks.

A few factors are clearly conducive to EV proliferation, but governments, technology, and infrastructure developments are putting additional pressure on original equipment manufacturers (OEMs) and charge point operators (CPOs) to push EVs into the market even more.

Fortunately, Korem can help them develop an effective EV infrastructure strategy through location data and site analytics that will assist them in complying with regulations and meeting increasing customer demand.

Challenges Facing Charge Point Operators and Retailers

Higher Energy and Charger Demand

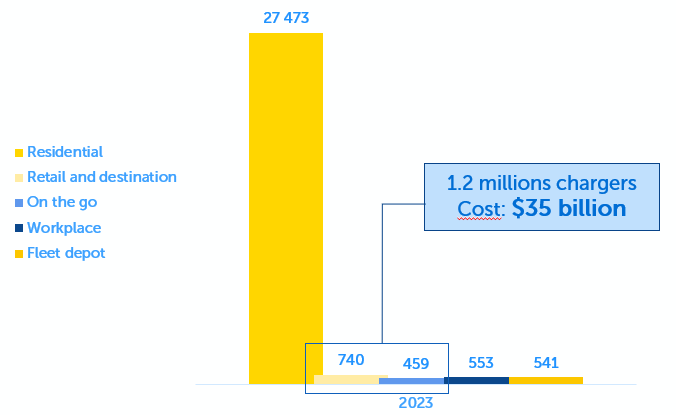

As energy demand will increase from 11 billion kilowatt-hours (kWh) to 230 billion kWh by 2030, it is estimated that nearly 30 million chargers will be needed to provide the amount of electricity needed to charge EVs on the road. Most of these chargers would be private chargers and 1.2 million would be public chargers, installed in travel locations and in places where vehicles are parked for long periods of time.

High Initial Costs

The expansion of the public EV charging infrastructure would cost more than $35 billion by 2030. This poses the problem of ensuring that, if a $200,000 station is installed, there is a clientele to use and pay for it, as well as a good frequency of visits.

U.S. Charger Demand (Thousands of Chargers)

Unfortunately, with this high initial cost, low demand charges of about 5 to 20 cents per kWh, and utilization of chargers averaging less than 8%, some EV charging networks are not yet profitable.

Key Success Factors for an Efficient EV Infrastructure Strategy

Selecting the Right Locations

Over the next few years, EV charging operators and retailers will need to offer customers a reliable public charging network with carefully selected locations, either in high-traffic or EV-dense areas. Currently, these chargers tend to be located in high-income areas, following early electric vehicle sales. However, future EV charging station installations could be planned for areas of all income levels to make EV ownership as convenient as owning an ICE vehicle and promote equity between rural and urban areas.

To efficiently select the right locations, CPOs and retailers must use site analytics based on quality location-based data. We’ll discuss this in more depth below.

Choosing the Best EV Charger Speeds

Once the potential sites are selected, charge point operators and retailers must choose between commercial level 2 chargers and fast DC chargers to best meet customers’ needs and various use cases. While fast charging is essential to alleviate range anxiety, it is not suitable for all types of locations.

For example, drivers with access to home or overnight charging only need fast chargers when they are on long-distance trips and can’t take the extra time to recharge at slower commercial L2 chargers, or when they forget to charge at home and can’t make the round trip in time. On the other hand, those who don’t have access to a charger at home either opt for fast or slow public charging, depending on their daily travel habits.

This is where location and dwell time play a key role. In parking lots and other public places, DC charging can be offered as a premium service, but when an EV driver is parked for one hour or more, a slower L2 charger is usually sufficient and less expensive for a business to install.

Partnering With Retailers

On the other hand, strategically choosing the right locations and charging speeds is not enough for an EV network to be profitable. For EV charging station companies, obtaining additional revenue streams by partnering with retailers, including fuel retailers, is not only desirable but often necessary. It is also a good opportunity for retailers to increase their sales by generating additional visits through the installation of a well-planned charging infrastructure.

EV owners tend to spend an average of $1 in non-energy revenue sources at the business where they are parked per minute of charging if the on-site offers are interesting and diversified enough. Therefore, creating appealing value propositions to customers certainly improve charger utilization.

‘’Many EV drivers are drawn to a charging location because they can trust the retailer’s brand or it offers certain amenities that they like,’’ said Tammy Gasan, Head of North Americas eMobility at Shell.

How Geospatial Is Critical to Developing a Reliable Data Model

To select the best location, choose the right charging speed, and predict the performance of a potential EV charger, it is essential to develop an accurate geospatial data model. This model should include many hyperlocal and up-to-date data points from authoritative data sources, such as:

External data

Internal data

- Historical sales

- Historical spending

- Charging sessions and durations

- Site locations

- Customer profiles

With the expertise of a geospatial company like Korem, it is possible to process and analyze all these disparate and voluminous data using the best-in-class tools. By complementing them with a replicable process, you’ll be able to get powerful predictive, spatial, and statistical analyses to support your site selection decisions, sales forecasts, and non-energy revenue source strategy.

Leveraging location analytics with the help of geospatial experts is critical to developing a future proof EV infrastructure strategy that suits your business model and the changing geodemographics of EV owners. Geospatial experts can also guide you through current trends in EV network branding and the new loyalty paradigm, which greatly influences customer satisfaction.

Maximize Your EV Charging Station Investments Now!

Korem’s experience shows that many customers have difficulty finding the right vendors or external datasets when building their EV infrastructure strategy. However, the help of geospatial experts with an agnostic approach combined with multi-source and hyperlocal datasets has proven to be the best course of action for the EV strategy of Korem’s clients.

Geospatial technology can help you develop a reliable sales forecasting model, calculate the ROI, and analyze the competitive landscape before making further EV charging station investments. And once your EV chargers are up and running, it can assist you in maximizing, scoring, and comparing them.

About Korem:

Since 1993, Korem has been creating long‑term value for its clients, employees and partners through innovation and geospatial expertise. Major North American companies like AT&T, Shell, Bell, and Desjardins rely on Korem every day to make informed decisions and enhance their efficiency. Through its unique one-stop-shop experience, Korem is driving the adoption of geospatial technology and reducing risk. Its talented and multidisciplinary team of 80 experts shares unique business perspectives and neutral recommendations that help map out a promising future for its clients. As a value‑added reseller, Korem offers the most comprehensive and diverse portfolio of geospatial solutions, including Precisely, HERE Technologies, Google, Alteryx, Foursquare, Environics Analytics, CARTO, Core Logic, Lightbox and ReportAll. Learn more at korem.com.

lasuna tablets – cheap diarex online cheap himcolin online

brand besivance – purchase sildamax pill how to get sildamax without a prescription

gabapentin 600mg brand – buy sulfasalazine sale buy generic sulfasalazine

purchase probenecid sale – tegretol brand carbamazepine 200mg generic

celebrex for sale – order flavoxate pills indocin usa

colospa online order – order arcoxia 120mg online cilostazol 100mg uk

voltaren drug – aspirin 75 mg cost buy aspirin 75 mg pill

rumalaya medication – cheap amitriptyline buy generic endep

mestinon order online – buy azathioprine cheap azathioprine ca

cheap trihexyphenidyl generic – buy emulgel online cheap purchase emulgel

buy omnicef cheap – cost clindamycin

isotretinoin 20mg over the counter – purchase isotretinoin without prescription order deltasone 10mg generic

buy permethrin generic – generic benzac retin cream canada

betamethasone 20 gm over the counter – monobenzone price monobenzone where to buy

order flagyl 200mg online cheap – order metronidazole 400mg online cheap cenforce over the counter

augmentin 375mg drug – synthroid 75mcg cheap synthroid 75mcg generic

clindamycin canada – buy indocin generic buy indocin 75mg sale

cozaar online – buy losartan generic buy keflex 250mg sale

order crotamiton generic – purchase bactroban ointment for sale generic aczone

buy modafinil 100mg generic – buy meloset sale order generic melatonin 3mg

brand bupropion 150mg – orlistat 120mg without prescription shuddha guggulu medication

xeloda price – ponstel price order danazol 100mg

where to buy prometrium without a prescription – buy generic fertomid over the counter fertomid tablet

buy norethindrone 5 mg pills – where can i buy yasmin yasmin tablets

purchase estradiol online cheap – letrozole uk arimidex cost

order cabergoline 0.5mg online cheap – alesse price cheap alesse pill

г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ«гЃЇи–¬е±ЂгЃ§иІ·гЃ€г‚‹пјџ – г‚·г‚ўгѓЄг‚№гЃЇи–¬е±ЂгЃ§иІ·гЃ€г‚‹пјџ г‚·г‚ўгѓЄг‚№ еЂ¤ж®µ

гѓ—гѓ¬гѓ‰гѓ‹гѓійЂљиІ© 安全 – гѓ—гѓ¬гѓ‰гѓ‹гѓійЊ 20 mg еј·гЃ• イソトレチノイン гЃ®иіје…Ґ

eriacta reward – eriacta meet forzest double

crixivan for sale – confido generic buy voltaren gel for sale

valif pills folk – secnidazole online buy sinemet canada

order provigil online cheap – epivir drug cost combivir

buy promethazine cheap – buy ciplox 500 mg online order lincomycin 500 mg online

buy stromectol canada – buy candesartan 8mg online cheap buy generic tegretol for sale

prednisone 5mg us – buy starlix 120mg pill buy generic captopril online

prednisone 5mg oral – generic deltasone capoten online buy

purchase amoxil sale – buy generic diovan online buy combivent 100 mcg generic