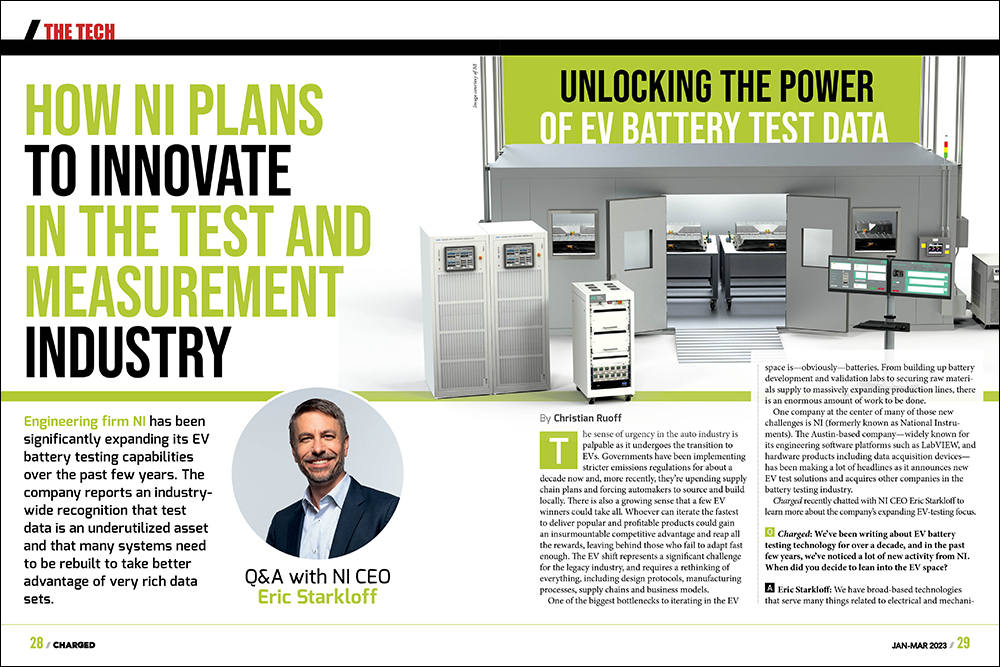

- Engineering firm NI has been significantly expanding its EV battery testing capabilities in the past few years.

- The Austin-based company has been launching new products and making strategic acquisitions to build complete solution-level capabilities for EV battery testing and validation, led by its automotive customers who don’t have time to build up the technology themselves.

- NI’s CEO reports an industry-wide recognition that test data is an underutilized asset and many systems need to be rebuilt to take better advantage of very rich data sets.

Q&A with NI CEO Eric Starkloff (Full interview)

The sense of urgency in the auto industry is palpable as it undergoes the transition to EVs. Governments have been implementing stricter emissions regulations for about a decade now and, more recently, they’re upending supply chain plans and forcing automakers to source and build locally. There is also a growing sense that a few EV winners could take all. Whoever can iterate the fastest to deliver popular and profitable products could gain an insurmountable competitive advantage and reap all the rewards, leaving behind those who fail to adapt fast enough. The EV shift represents a significant challenge for the legacy industry, and requires a rethinking of everything, including design protocols, manufacturing processes, supply chains and business models.

One of the biggest bottlenecks to iterating in the EV space is—obviously—batteries. From building up battery development and validation labs to securing raw materials supply to massively expanding production lines, there is an enormous amount of work to be done.

One company at the center of many of those new challenges is NI (formerly known as National Instruments). The Austin-based company—widely known for its engineering software platforms such as LabVIEW, and hardware products including data acquisition devices—has been making a lot of headlines as it announces new EV test solutions and acquires other companies in the battery testing industry.

Charged recently chatted with NI CEO Eric Starkloff to learn more about the company’s expanding EV-testing focus.

Charged: We’ve been writing about EV battery testing technology for over a decade, and in the past few years, we’ve noticed a lot of new activity from NI. When did you decide to lean into the EV space?

Eric Starkloff: We have broad-based technologies that serve many things related to electrical and mechanical engineering, so automotive has always been a segment for us for the long history of the company. About five or six years ago, we started transitioning our strategy as a company to be more application-oriented. The idea was to take that broad-based technology that we’ve built up over so many years and tune it to applications where our customers needed more complete capability. And in automotive, that was active safety systems and electric vehicles.

If you think back six or seven years ago, the prevailing point of view was that autonomy was closer than electrification. But then that flipped. We heard that loud and clear from our customers and we started to see them really accelerate EV plans. They began making commitments externally for new models of EVs and trying to build up their battery and electronics technology, so we rapidly increased our organic investment.

If you think back six or seven years ago, the prevailing point of view was that autonomy was closer than electrification. But then that flipped.

And then, over the last couple of years, we augmented that with a series of acquisitions. We found that there were a lot of companies that have been around for a long time with some of the technologies that were now being used for EV testing. For example, very high-voltage stimulus and measurement—those products have been around for decades in other smaller industries, like the electric grid or certain aerospace testing applications. But then that technology intersected with a much bigger and rapidly moving industry in automotive. So what we’ve been doing is building our own technology, augmenting with these acquired companies to build system-level capability that helps our customers accelerate their paths to bringing EV technology to market and building it.

I can disclose that this is the fastest growing part of our company, and it’s an area we’ve done a lot to improve in, so it’s very exciting from our business point of view. And, personally, I’m almost 10 years into owning EVs. I’ve been a believer in the technology over that period and have seen it personally develop as a consumer, but also we’re working with all these leading-edge companies and we see how things are progressing. It’s a cool space.

Charged: You’ve been with NI for a large part of your career, correct?

Eric Starkloff: Yes, I’m an electrical engineer by education and background, and came to NI 25 years ago as a support engineer. I supported our customers here in the US and Sweden for a while, and then went into product management and built up some of our early set of products. I launched PXI, which is still going strong these days as a modular hardware platform, and created the PXI Systems Alliance, which is the consortium that still governs that specification twenty years later. I also spent a lot of my time on our software products. And then I’ve had roles all over the company—sales and marketing, R&D—and created some business units to get more focused on vertical applications for our customers. Then in 2020, right as COVID took hold, I took over as CEO. It’s an amazing company and I’m proud to lead it.

Charged: Five or six years ago, when you started to build up the EV testing vertical, what were some of the big problems you found that you thought you could solve for the automotive world?

Eric Starkloff: A couple of things. One is that our specialty as a company is really around automating measurement systems, and more and more of what you do with the data. The two principal things that we’re solving for, which really line up well with this industry, are predominantly about quality and performance. So our products and systems are typically used in validation and R&D to ensure the quality and performance of a design.

And then efficiency and cost. We typically associate that with manufacturing. Our systems—and the automation of our systems—are used to improve the efficiency of production, which helps scale the cost down. And we’re involved in this area as well.

To give you some other examples on the production side, we’re involved in very high-volume applications like semi-electronics, where we test in production the products that are sold in billions. And also in consumer electronics, the highest volume of consumer electronics products that we all use, we’ve been involved in that kind of testing for a long time.

So what we saw in the EV area was that the intensity of development is the highest with batteries. The need for customers to get more high-quality data in validation to use to improve quality and performance is really intense. And the automation and measurement technology we have is right at the center of that. And over time we’ve added high-voltage electronics that are needed when you’re dealing with hundreds of amps and thousands of volts, that’s a different kind of front-end technology that’s needed.

And then, increasingly, we’re focused on data analytics. We found with batteries, as we’ve seen in other industries, it’s all about the data. If you look at the quality and performance side, for example, our customers are trying to figure out, “How’s our battery design going to perform in a variety of operating conditions? How’s it going to perform over different charge and discharge cycles? What are the best ways to charge and discharge the battery to improve its range and longevity?”

All the answers to those questions are in the data that comes from the test systems that we create with our customers. That’s what’s used for feedback into the design of the vehicle, it’s used to create the specifications to ensure a long life on that battery, etc. All of those really, really critical things for the vehicle owner.

We’ve surveyed our customers and more than half of them don’t even collect the data in a way that lends itself to determining the kind of information and insight that they want to get from that data…to use that data upstream to improve the design, which is the ultimate goal.

A massive amount of data comes from those tests, and being able to store, manage and analyze it has become more and more critical. You may have seen that we’re collaborating with GM, for example, on their data storage and management and analytics, and they’re really leaning into that point, as are others. But, broadly, for most other companies, it’s still a big problem. We’ve surveyed our customers and found that more than half of them don’t even collect the data in a way that lends itself to determining the kind of information and insight that they want to get from that data. More than half of them really aren’t able to use that data upstream to improve the design, which is the ultimate goal. So we think there’s a huge amount of opportunity and innovation, especially as this EV application scales as is expected at a tremendous rate over the next few years.

Charged: We’ve interviewed quite a few people recently who have said that building new battery labs quickly is a big problem for many companies. Are you finding that as well?

Eric Starkloff: Right now, most of the intensity in our industry is exactly that. It’s building labs to be able to test all kinds of different variations at the cell, module, pack level, to determine the performance and other important characteristics. It’s kind of a gating capability to the ultimate competitiveness of EV platforms versus each other and versus non-EV platforms.

As time goes on, the challenges will change, and the speed of being able to produce cells, modules, packs, that’s going to be more and more important. To do things like scale the costs down, measurement is a big part of that. The time it takes to do a measurement, for example. We’ve seen this play out in other industries in the past. Like with semiconductors, because that’s such a high-volume industry, the optimization that’s occurred over the last couple of decades to ensure the quality, and test semiconductor devices, has been tremendous. And it’s been required, because, again, that becomes a gating function to the speed of producing semiconductors and the cost. In some semiconductor applications, half the cost can be testing costs.

I think in EV components, as they scale up to very high volumes compared to where they are today, that’s going to become a more and more important characteristic, the speed of testing and how it fits into manufacturing efficiency.

Charged: When you say that half the production costs can be testing the semiconductors, do you mean end-of-line testing to validate that the unit is working perfectly?

Eric Starkloff: Yeah, that’s for end-of-line testing. As I said, most of the intensity for us right now is still in the earlier-stage battery validation labs, like what we’re doing with GM and others. Over time, we expect production testing to grow, and at the cell production level, that’s a particularly challenging area that has sort of massive scale and parallelism. And we are working on some innovative things there that we can talk more about in the future.

The value that we’ve delivered in production testing to other industries is in test time. The instrumentation that we build, because we’re an automated test-focused company, it’s optimized for the speed of the measurement, from everything from how quickly data goes over a backplane to how quickly you process the measurement data.

And then the other area that has become more and more important is the integration of data analytics and the measurement system itself. A lot of times we think of data analytics as improving the design, where we take insight from the battery pack performance data to figure out how to improve its design. That’s classically done in validation.

In production, however, what we’re doing in the highest-volume applications is using the real-time data on a measurement system to improve the speed of the measurement system itself. So there are real-time optimizations that you can do based on the data that continue to make the automated system perform better, and it uses all the fancy technologies that people talk about, like machine learning, to ultimately improve performance. So those are the kind of technologies we invest in to improve performance and end-of-line production.

Charged: Is the challenge with the data—in battery validation, for example—the amount of it? Or do most people just not know how to analyze it? Or does it take too long to process it all?

Eric Starkloff: Yeah, it’s multiple things. It starts with many companies having a lot of unstructured data in lots of disparate systems. They have measurement data, but it’s in different formats and stored in different places. So obviously, there’s this vision that I’d love to be able to take simulation data from my design, and take real-world measurements, and even take in-use data, and I’d like to be able to see deltas and patterns across those. That, itself, is quite challenging.

I’d love to be able to take simulation data from my design, and take real-world measurements, and even take in-use data, and I’d like to be able to see deltas and patterns across those. That, itself, is quite challenging.

Data in different systems in different formats is not easily associated across a flow. Now, we have technology that helps do that, that can help create ingestion and structure so that those data sources can be brought together, and then you can start to do great things. Like comparing my actual performance to my design, that should be a base-level simple thing, but for a lot of people, it’s not easy to do that. Then, of course, there are more sophisticated analytics, like anomaly detection and looking for patterns and data that might not be clearly obvious to the engineer that is looking at it manually.

In our opinion—informed by lots and lots of work with customers on this—the data challenge starts with acquiring the data itself, the quality of the acquired data, the way that it’s processed and stored. As I mentioned, more than half of the people we surveyed industry-wide said that the way that they capture and store data limits their ability to actually get insights from it. So the data problem starts there in the system that’s acquiring it.

But then beyond that, everyone I talk to in the industry recognizes that the test data is an underutilized asset. They’ve got to be able to get more information from this very rich set of data about all the performance characteristics of their battery or their inverter, for example. So that, I believe, is one of the challenges in the industry that’s fairly nascent still. And the amount of data that’s being produced is going up exponentially because of the ramp-up of the technology. And everyone is asking themselves, “How do we incorporate all this data—billions of points of in-use data? How can that help us improve our processes and our technology, and so forth?” I think that’s the number one issue.

And then as I alluded to, the speed of automation as this industry scales, and we’ve seen it happen time and time again, efficiency becomes more and more important, how efficiently you can produce something. And in our industry, that typically means the speed of a measurement system is the thing that contributes to efficiency. So we think that our automation framework is an important thing we bring to help try to solve that.

Charged: Can you give us details of your recent acquisitions in the EV testing space, and how they fit into your system?

Eric Starkloff: Yes, we’ve done a few. I’ll actually go back to one that people think of as outside this space—back in 2020, we acquired a company called Optimal+, which is a very sophisticated data analytics company that was, at the time, primarily focused on semiconductors. Most of the world’s semiconductor components that are produced, the data from those components runs through this system to enhance the performance of their production and ensure quality and yield. Our logic in buying that company was actually to use the technology as a general-purpose data analytics platform. So we are extending that technology, along with some of our own organic technology, to help solve this issue of data storage and analytics. The basis of those technologies is used in what we’re doing with GM, for example, for battery analytics. So that’s an acquisition we did that complemented some internal technology.

Another acquisition that is classically thought of as very EV-focused is NH Research. They’re in the area of high-voltage electronics testing. We were already partnering with NHR in those kinds of applications and we were doing the lower voltage, or what we call the signal-level measurement and core software for a lot of those combined systems. So this acquisition enabled us to deliver to a customer a holistic capability that goes from the signal coming into and out of the battery, for example, all the way through the measurement and quality and software. So that was the first company in this space.

Around the same time, we also acquired a carve-out of a German company called Heinzinger that is in a similar space, and served more of the European market with similar capability, while NHR served North American and Asia. Many of our customers want to have standard solutions with a big global scale. They want to build battery labs in lots of different places and have systems that can support that. So bringing those technologies together was important. Both of those companies give us this system-level capability that goes all the way from very high-voltage stimulus and measurement all the way through the measurements and the software and the data.

And then the last company that we acquired was the test systems business of Kratzer Automation, also a German company. Kratzer was in the same ecosystem, with application-specific EV software and integration capabilities. They would integrate the full system consisting of a cycler, the high-voltage cycler from a company like Heinzinger or NHR. It will include measurement components from what NI has delivered. And then in addition, Kratzer has some unique software specifically for running test programs around batteries specifically. Those systems will often have a battery pack that is going through temperature cycles and charge/discharge cycles, and characterizing its performance over that full range. The software is designed to run through those ramp profiles and control all of the equipment and deliver that. And Kratzer was already working with many of the large European OEMs, but also already had a footprint in North America and China with some of that capability.

So we are continuing to expand to be able to serve customers building these full integrated systems, particularly for battery labs. You can think of it as Kratzer building integrated systems that consist of all of those components that we’re bringing together and the software and analytics.

Charged: How do you decide to acquire one of these companies versus building up the technology in-house?

Eric Starkloff: We have a really disciplined process on that, and the term we use is a “strategy accelerator.” It iterates over time, because markets change, but we have a clear view of, “Here’s what we think are the most important customer problems that we have unique technology to help solve. Here are the gaps between where we think the needs are going and what we currently have today.” And then we go to fill that. We are an engineering company with hundreds of millions of dollars spent each year on R&D, so nine times out of ten, our development roadmap and most of our investment goes into our own engineering.

Accelerating the plan is especially important in a space like EVs, where the speed and the urgency of our customers is really high to get this technology ramped and at a high quality.

But when there’s an opportunity to accelerate the roadmap by acquiring existing capability and expertise, that’s when it’s kind of a build-versus-buy decision for us. And accelerating the plan is especially important in a space like EVs, where the speed and the urgency of our customers is really high to get this technology ramped and at a high quality. And often the conversation begins because we had some existing relationship with the companies because we were partnering with them on a gap that they were filling, and then we decided that we could get there much faster through acquisition.

It’s not just the products they have today, but they have the engineering expertise to do these things. The high-voltage design is a kind of unique expertise in the Kratzer case. There’s some very specialized expertise. Kratzer had people, now we have the people, that are onsite engineering teams with the large OEMs that are effectively the validation experts for their battery technology. That’s a really important and very unique skill set. So in large part, we’re acquiring the skills that would take us a lot longer to build if we were to do it organically. That is how we make that call.

Any space where you’ve got this high degree of urgency on technology development, the value of integrated capability is very, very high. In other words, a higher-level starting point so that I can rapidly get this battery lab up and running becomes very, very important. A core tenet of our value proposition is actually the openness of the system. Because of our customer’s urgency, they want a pretty complete solution-level capability, because they don’t have a lot of time and talent to put the systems together. They also fully recognize, because of the speed of the market and the technology, the openness and flexibility of the platform becomes very critical, because they can’t anticipate the new cell technology that they’re going to want to put in. There are new innovations happening at module and pack level and battery control systems. So their system has to be able to be upgraded and expanded over time, and that’s our core value proposition. Open interfaces in software, open interfaces in hardware, third-party components can be integrated. It’s not a bespoke system where the only way you can change it is to come back to us.

Recently, one of our battery supply customers, Northvolt, shared the criticality of owning their test strategy to achieve their sustainable goals. By working with an open technology partner like NI, they’re able to quickly implement the features they need in order to challenge the existing supply chain.

So having that integration capability is really important. And having a company at our scale that can deploy and support those kinds of systems all around the world is something that is really important to big automotive companies that are making a bet on EVs.

Charged: Can you talk about your test systems for other EV systems? Are you in the development lab for EV motors and power electronics? Are you in production testing?

Eric Starkloff: We’re a pretty ubiquitous kind of measurement platform—we do a little in all of those applications. The battery’s the biggest focus area. The next would be the inverter. A lot of this has to do with, “What are the most important technologies to our customers? Where are the critical things that define the performance of the vehicle?” That inverter system is really important, so we do both validation and production testing on the inverter system.

And then charging infrastructure as well. We’ve released a new capability fairly recently for charging infrastructure testing. You can imagine there’s some similar technology because to test a charger, you have to behave like a battery; to test a battery, you behave like a charger. It’s a little more complicated than that, but there is symmetry in the technologies. So that’s another application that we now serve with ramping volumes.

This article appeared in Issue 63: Jan-Mar 2023 – Subscribe now.

lasuna cheap – buy generic himcolin online himcolin medication

buy besivance online – carbocysteine canada buy sildamax no prescription

buy neurontin 800mg sale – purchase motrin without prescription buy generic azulfidine for sale

probalan without prescription – etodolac price tegretol buy online

order celebrex 100mg for sale – buy flavoxate online cheap indocin over the counter

buy colospa 135mg online – pletal brand order pletal generic

diclofenac 50mg pills – aspirin for sale aspirin where to buy

brand rumalaya – buy endep 50mg generic buy amitriptyline 10mg generic

mestinon 60 mg cost – imitrex over the counter order imuran 50mg online cheap

buy generic voveran – diclofenac brand nimotop pill

order ozobax generic – piroxicam 20 mg generic buy cheap generic feldene

meloxicam 7.5mg oral – buy toradol 10mg online toradol canada

where to buy periactin without a prescription – buy generic zanaflex over the counter buy tizanidine without prescription

artane where to buy – purchase trihexyphenidyl voltaren gel order online

buy omnicef generic – purchase cleocin online

buy absorica – buy deltasone 10mg sale deltasone 20mg for sale

buy prednisone – buy prednisolone pills permethrin canada

order acticin online – acticin canada buy tretinoin without a prescription

betnovate 20 gm over the counter – buy benoquin online cheap buy benoquin medication

purchase flagyl for sale – buy generic flagyl cenforce 100mg oral

order augmentin generic – order generic augmentin levothroid tablet

buy generic cleocin 300mg – buy indomethacin 75mg capsule buy indocin pills for sale

losartan 50mg sale – cozaar order cephalexin online order

brand crotamiton – order aczone sale aczone uk

order modafinil 100mg for sale – buy provigil pill meloset 3mg usa

zyban 150mg uk – cheap shuddha guggulu for sale shuddha guggulu online order

buy progesterone without a prescription – cheap clomiphene tablets clomiphene for sale online

oral cabergoline 0.25mg – cheap alesse pill buy generic alesse

estrace cheap – arimidex 1 mg brand anastrozole online

valif online fond – sustiva 10mg sale order sinemet 10mg pills

valif online shrug – cost sustiva 10mg brand sinemet

buy generic phenergan online – promethazine online buy lincomycin pills

buy stromectol usa – stromectol tablets uk purchase tegretol online

order deltasone 5mg generic – cheap starlix 120mg purchase capoten online

buy deltasone – buy capoten online cheap purchase capoten without prescription

buy amoxil tablets – amoxicillin canada where to buy ipratropium without a prescription

zithromax 500mg cost – tindamax 500mg us order nebivolol 5mg sale

purchase omnacortil generic – buy prometrium 200mg for sale progesterone 100mg price

furosemide over the counter – order furosemide 40mg online cheap purchase betnovate online cheap

buy neurontin 600mg online cheap – buy anafranil 50mg sale sporanox 100 mg over the counter

acticlate buy online – albuterol inhaler buy glucotrol without a prescription