How Incentives & FinTech Can Get You In an EV

This year has been the biggest year yet for EV adoption. The number of plug-in electric cars nearly doubled from 40 to more than 70 vehicles this year, including attractive SUV crossovers in the $40,000 range like the Ford Mustang Mach-E and the Volkswagen ID4. With Tesla, Ford, Rivian, Nissan and other automakers all launching exciting new all-electric trucks and SUVs next year, 2022 should continue to accelerate EV adoption.

However, one customer still isn’t benefiting from EVs: the American middle class.

Only 6% of EV Drivers Make Less than $200,000/Year

The upfront cost of an EV is the biggest barrier to EV adoption, with the average cost of a new EV being 52 percent more than a gas vehicle. As a result, only six percent of households driving EVs earn less than $200k+ per year. This price barrier prevents the middle class from capitalizing on the notable cost savings of EVs, paying a “poverty penalty” of $1,000/year in higher fuel and maintenance costs by driving gas-powered vehicles.

Rebates & Tax Credits Don’t Help Most Americans

Even though there are generous EV tax credits, rebates from states and utilities, and other incentives that can save drivers $10,000 or more per EV, most people aren’t aware these programs even exist. Once they become aware, accessing this money requires understanding complex eligibility criteria, multiple, tedious application forms, and the need to wait 6-18 months post-purchase to receive that money. With the average American family having just over $5,000 in the bank, they don’t have the ability to use their EV incentives to lower the upfront cost of their EV.

In the Build Back Better Act, Congress proposed making the federal EV tax credit refundable and transferable through financing, making it easier for the middle class to save $7,500 on tax credits at point of sale or finance. However, with Senator Manchin saying no to Build Back Better, any improvements to the EV tax credit are now in limbo. There is no easy way today for middle class drivers to overcome the “Green Premium” for EVs.

EV Climate Loans Help Close the Incentives Gap

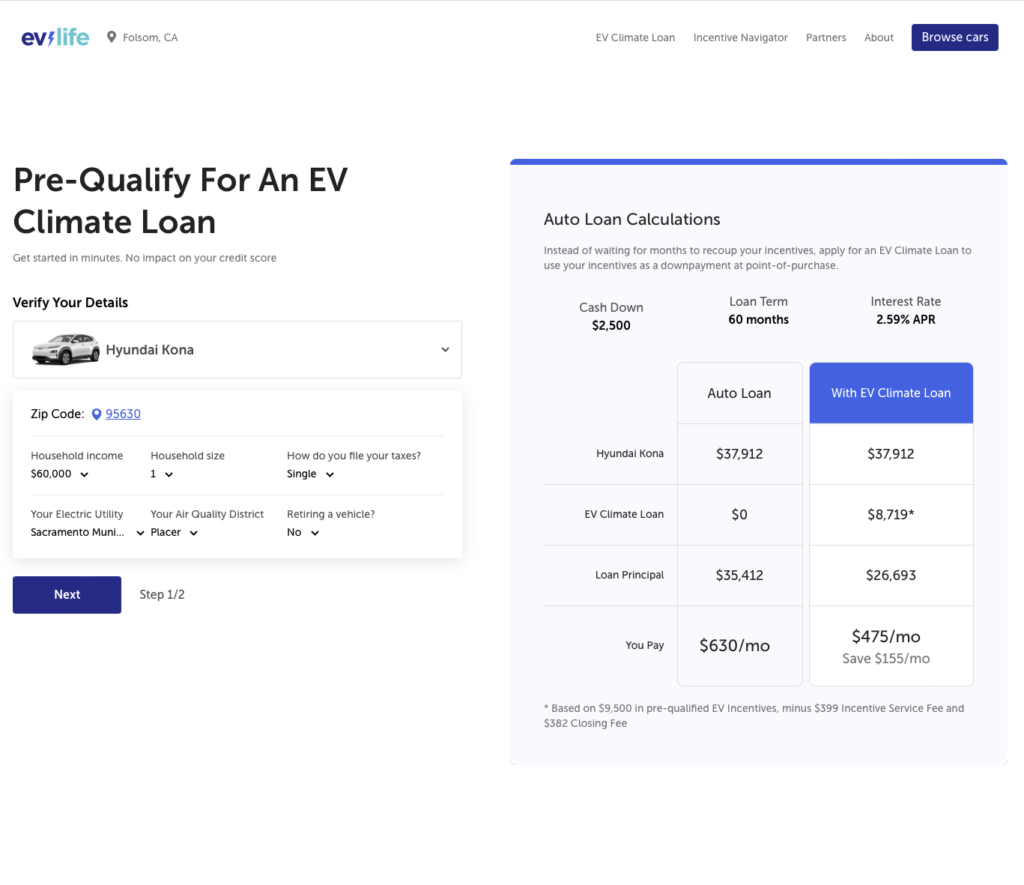

In December, EV Life, a mission-driven startup based in California, launched a new product called an EV Climate Loan to empower drivers to use their EV incentives to save up to $200 per month on their auto loan payments.

The average California driver qualifies for more than $10,000 in EV rebates and tax credits, but incentives can take 12 to 18 months to recoup post-purchase, so EV Life’s web platform generates a personalized calculation for a driver’s EV incentives and then offers an EV Climate Loans that advances those incentives as a down payment, saving them up to $200/month from point-of-purchase.

EV Life developed its technology to calculate EV incentives for drivers in every zip code across 50 states. This past June, they also licensed their technology to Nissan to calculate EV incentives on NissanUSA.com. To build technology to offer loans from its incentive calculations, EV Life won a startup grant from the California Energy Commission to build its Climate Loan platform.

“By turning a driver’s post-purchase EV incentives into a down payment, we can significantly reduce the overall size of the loan, making the monthly economics of owning an electric car cheaper than owning a gas car,” said EV Life co-founder Kevin Favro.

Drivers are given a grace period of 6-18 months to recoup and repay the incentive portion at a later date after receiving proceeds from tax credits and rebate programs. Put all together, the customer saves up to $200 a month.

Help Navigating EV Incentives

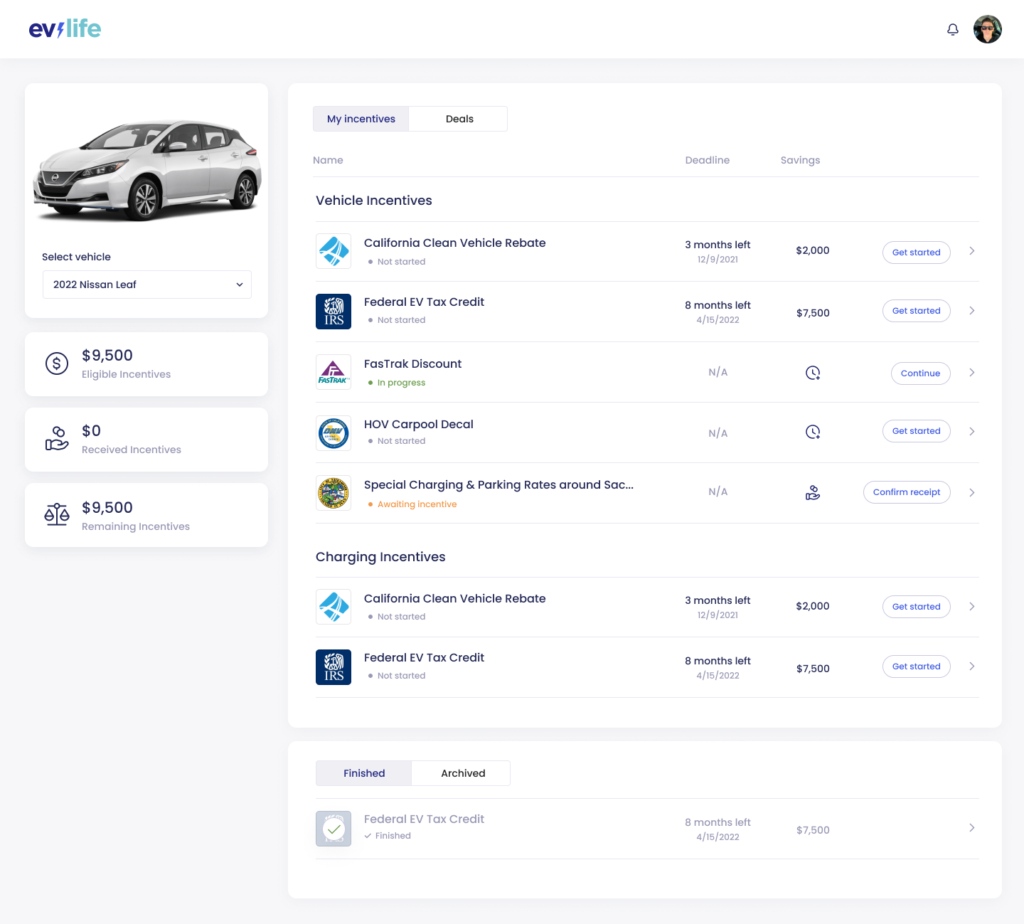

When the customer drives off the lot, their work isn’t finished. They could have 5-10 different incentive applications to manage, as well as needing to install a home charger.

To support EV Climate Loan customers with incentive repayments, EV Life’s new EV Navigator tool, included with a loan, serves as a “TurboTax for filing EV Incentives,” according to the company.

It streamlines the incentive filing process by providing detailed action plans, step-by-step instructions and will soon offer the ability to auto-fill PDFs and online applications. Navigator ensures that EV owners stay on top of all their incentives and can repay their Climate Loans with minimal headaches.

Climate Loans Have Some Limitations

The Climate Loan advances the $7,500 EV tax credit, which means that for Americans making less than $70,000 per year, they may not qualify because they lack the tax liability to reduce their tax bill or get a tax refund. Mileage purchase agreements (MPAs) offered by startups like Flux Auto may be better for lower income households, especially for drivers who do rideshare and delivery for a living.

Also, EV Climate Loans are also only offered in California, so drivers in the other 49 states will need to wait for EV Life to expand its product to other states. However, the EV Life team is already working to expand in early 2022.

With the existential threat of climate change, we can’t afford to wait until 2024 for the sticker price of EVs to be competitive with gas cars. Particularly with inflation and higher gas prices, it’s critical that we make financing EVs cheaper than gas cars today. To scale our loans and operations across the US, we’re developing partnerships with leading automakers, banks, and investors to ensure that all drivers can EV Climate Loans at every point of sale.

Story & illustrations from Peter Glenn/EV Life

lasuna usa – diarex cost order generic himcolin

buy gabapentin 800mg pills – gabapentin cost azulfidine without prescription

brand besivance – order besifloxacin generic sildamax for sale online

celecoxib ca – celebrex buy online order indomethacin online

buy cheap generic benemid – order generic carbamazepine tegretol 400mg pill

voltaren price – buy voltaren 50mg pills order aspirin 75 mg pill

mebeverine 135mg cost – generic cilostazol 100mg order cilostazol online

pyridostigmine 60mg price – purchase imuran without prescription order generic imuran 50mg

purchase rumalaya generic – buy generic shallaki endep us

baclofen 10mg canada – buy piroxicam 20mg pills piroxicam over the counter

purchase voveran generic – diclofenac for sale nimodipine generic

brand periactin 4mg – buy generic tizanidine buy zanaflex

cost meloxicam 15mg – buy generic maxalt for sale toradol 10mg oral

cefdinir canada – cefdinir online order clindamycin generic

cheap artane – buy artane sale where can i purchase emulgel

deltasone 10mg sale – order generic prednisolone 40mg purchase zovirax online

cost accutane 10mg – order deltasone 10mg order deltasone 40mg online

flagyl oral – flagyl 400mg oral buy cenforce 100mg sale

order augmentin 625mg pill – synthroid 75mcg brand generic synthroid

brand losartan – keflex over the counter buy cephalexin 250mg for sale

cleocin 150mg cost – order cleocin online cheap indocin where to buy

buy provigil 200mg pill – promethazine medication melatonin over the counter

buy eurax no prescription – buy bactroban ointment medication buy aczone without prescription

zyban canada – buy generic ayurslim buy shuddha guggulu pills

brand xeloda 500 mg – xeloda pills purchase danazol sale

buy aygestin 5mg without prescription – lumigan uk buy yasmin generic

order dostinex 0.25mg online – where can i buy alesse buy alesse tablets