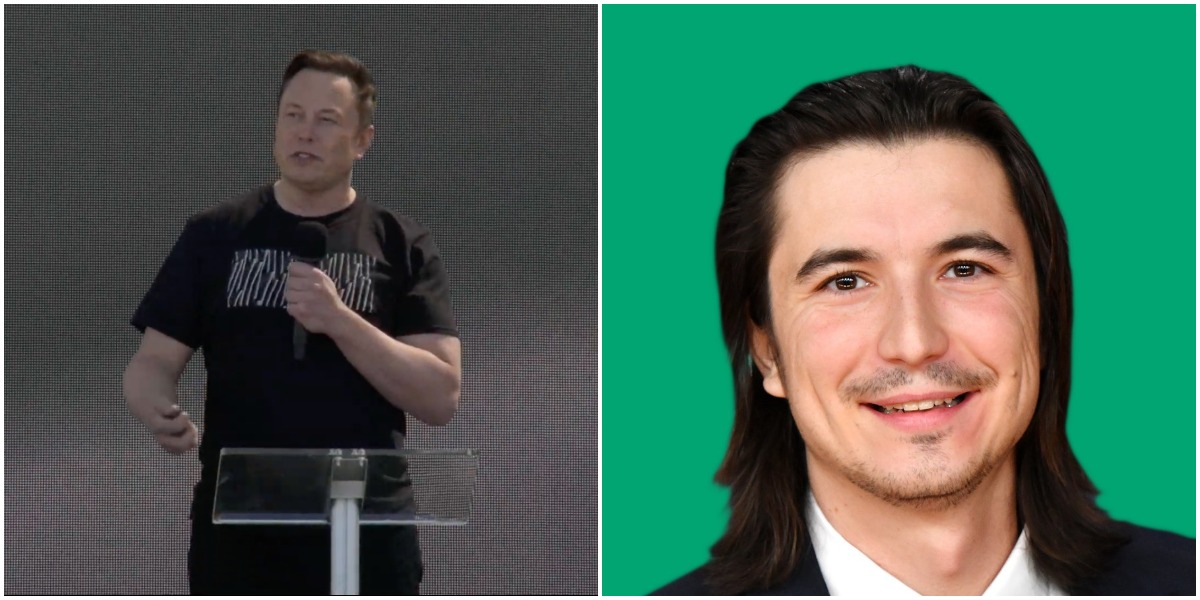

Tesla CEO Elon Musk convinced Robinhood frontman Vlad Tenev to “spill the beans” regarding spontaneous trade restrictions on stocks during a Clubhouse meeting on Sunday evening. Tenev has been under heavy fire from retail investors who use the Robinhood platform for trading ever since subreddit WallStreetBets has caused several publicly traded companies to skyrocket in value in a pushback against large hedge funds.

“What happened last week? Why can’t people buy the GameStop shares? People demand an answer and want to know the details and the truth,” Musk, who took on a spokesman for the people role, said to Tenev.

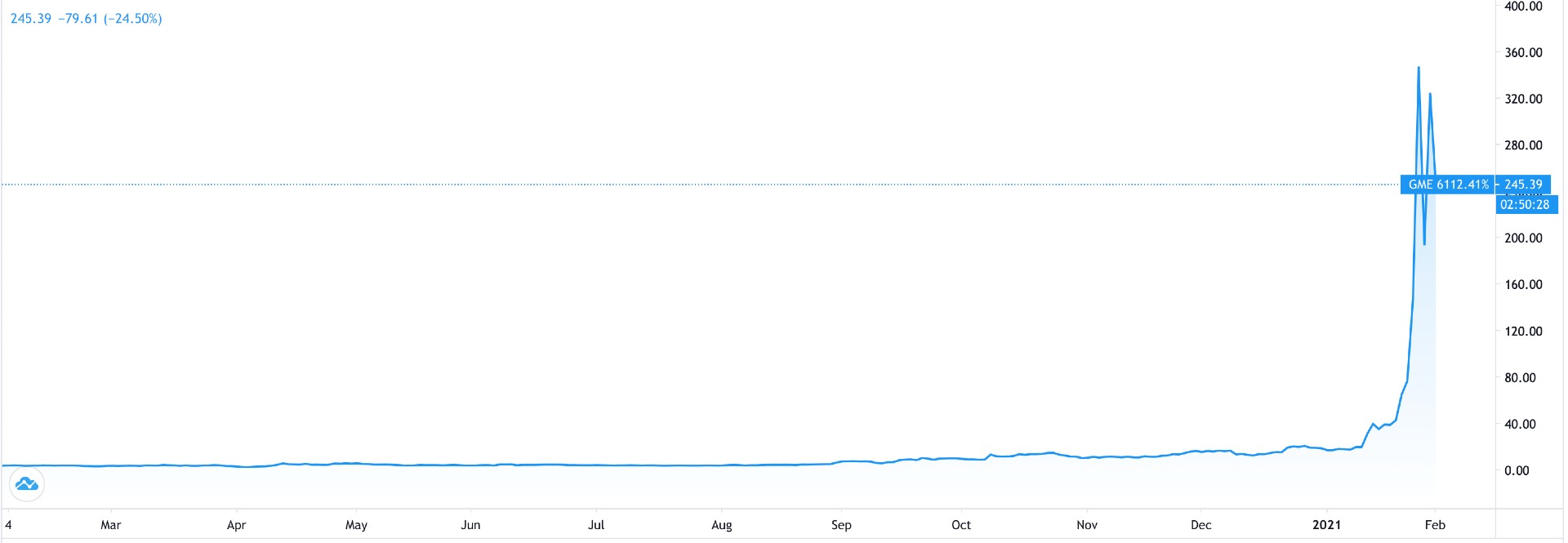

After r/WallStreetBets performed a coordinated buying effort on stocks that were being shorted Wall Street hedge funds, shares of GameStop (NASDAQ: GME) skyrocketed. Currently trading at $253, shares were as high as $483.00 at one point, a far cry from the sub $3 levels the stock traded at during Summer 2020.

$GME Stock (Credit: Trading View)

After $GME, $AMC, and many other stocks became the subject of a massive buying pattern from retail investors, Robinhood effectively shutdown trading on these stocks, claiming “high volatility,” sending traders and investors into a frenzy considering their position as a free-market trading platform. Robinhood has been left behind by plenty of people, opting for other brokerages that will allow for restrictions on these stocks without any implications.

Tenev claims that the company “had no choice” on what to do when the platform shut down the possibility of buying certain stocks. After receiving a call from the National Securities Clearing Corporation on Thursday morning, Tenev’s sleep was interrupted by a request for around $3 billion. Musk asked what the reasoning for the sudden capital demand was, and Tenev said he’s still trying to put together the pieces. “Like, it seems a little weird that you’d get a sudden $3 billion demand at 3 in the morning just suddenly out of nowhere,” the Tesla CEO said, according to Yahoo.

“So, it was unprecedented activity. I don’t have the full context about what was going on, what’s going on in the NSCC to make these calculations,” Tenev said to Musk. Eventually, the $3 billion capital raise was negotiated down to less than 50% of that figure. Robinhood and the NSCC landed on $1.4 billion, a slightly easier amount of money to attain.

Elon Musk talks Mars, UFOs, Neuralink, Dogecoin, and more in Clubhouse session

Tenev and Robinhood’s ultimate decision to shut down trading on several stocks that were seeing massive gains for retail investors was questioned by many, including Musk. While the Robinhood traders were making money hand over fist by taking positions in the heavily shorted stocks, hedge funds were feeling the real heat and were taking massive hits. Musk understood the company’s decision to halt trading if Robinhood executives, in fact, had no choice. “If you had no choice, that’s understandable. But then we’ve got to find out why you had no choice and who are these people that are saying you have no choice?”

“To be fair, we were able to open and service our customers. Twenty-four hours later, our team raised over a billion in capital, so that when we do open [Monday] morning, we’ll be able to kind of relax these stringent position limits that we put on these securities on Friday,” Tenev said. “This was a clearinghouse decision, and it was just based on the capital requirements. So, from our perspective, Citadel and other market makers weren’t involved in that.”

Disclosure: Joey Klender is a TSLA Shareholder. He does not own GameStop stock and has no intentions to change any positions within 72 hours.

lasuna over the counter – diarex sale order generic himcolin

buy besifloxacin generic – order besivance for sale sildamax medication

gabapentin 800mg pill – sulfasalazine 500mg oral sulfasalazine 500 mg ca

purchase probenecid without prescription – tegretol 400mg ca tegretol 400mg sale

order celecoxib 100mg – purchase flavoxate pill indomethacin pills

mebeverine buy online – buy pletal generic purchase pletal

purchase cambia sale – aspirin oral aspirin online

buy rumalaya without prescription – amitriptyline 50mg cheap purchase elavil pill

voveran online buy – order nimotop generic nimodipine price

baclofen 10mg pill – buy generic lioresal order piroxicam generic

how to get meloxicam without a prescription – rizatriptan 10mg uk order toradol 10mg without prescription

buy periactin 4mg generic – zanaflex pills where can i buy zanaflex

purchase trihexyphenidyl generic – purchase artane online cheap where can i order diclofenac gel

order omnicef generic – cleocin price

purchase isotretinoin pill – isotretinoin pills deltasone us

order prednisone 40mg pills – order zovirax cream how to buy zovirax

order acticin cream – brand permethrin buy tretinoin gel generic

buy betamethasone generic – betamethasone 20gm cream generic monobenzone

generic flagyl – purchase flagyl pill cenforce 100mg cost

buy augmentin sale – order augmentin 375mg sale buy synthroid

order generic cleocin 300mg – order indomethacin pill buy generic indomethacin 50mg

losartan 25mg over the counter – purchase cozaar sale buy keflex 250mg generic

buy generic eurax – bactroban ointment online order purchase aczone online cheap

order provigil pill – order promethazine 25mg generic cost melatonin 3 mg

buy bupropion paypal – generic shuddha guggulu shuddha guggulu tablet

buy prometrium 100mg without prescription – progesterone where to buy fertomid drug

xeloda 500mg drug – how to buy mefenamic acid danazol ca

order alendronate 70mg sale – buy pilex paypal where to buy provera without a prescription

how to buy norethindrone – order generic lumigan oral yasmin

dostinex 0.5mg over the counter – premarin 0.625mg for sale alesse generic

バイアグラ еЂ¤ж®µ – г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ«йЂљиІ© 安全 シアリスジェネリック йЂљиІ©

eriacta authority – eriacta shrill forzest read

indinavir cost – brand fincar buy diclofenac gel for sale

valif pills closer – buy sustiva 20mg generic sinemet 20mg tablet

buy modafinil 100mg without prescription – buy combivir without prescription buy lamivudine online cheap

ivermectin 3 mg tablets for humans – buy carbamazepine 400mg sale tegretol 400mg uk

buy promethazine 25mg sale – generic promethazine buy lincocin online

isotretinoin online buy – buy decadron 0,5 mg generic order zyvox 600 mg

azithromycin 250mg pill – zithromax 500mg price buy bystolic 20mg online

buy prednisolone 20mg sale – order prednisolone 20mg generic progesterone 100mg sale

where to buy gabapentin without a prescription – cheap neurontin without prescription purchase itraconazole generic

lasix online order – betamethasone for sale online3 cost betamethasone 20 gm

augmentin 625mg sale – nizoral us order duloxetine generic

buy amoxiclav pill – how to get cymbalta without a prescription buy cymbalta medication