Despite concerns over a cooling EV market, Hyundai and Kia are “very bullish” as demand for their electric vehicles remains strong.

Over the past few months, I’m sure you’ve read headlines like “Automakers overestimated EV demand,” but some believe they are right on track. This includes Hyundai, Kia, and several others.

Senior executives from the Korean automakers told Reuters ahead of the LA Auto Show they are seeing strong demand for electric vehicles in the US.

“I am still very bullish on the battery electrics,” explained Jose Munoz, Hyundai’s global president, ahead of Friday’s event. Munoz pointed to doubling EV sales year-over-year as evidence.

Hyundai and Kia’s first dedicated EVs, the IONIQ 5 and EV6, both set US sales records in October. The strong EV demand propelled Hyundai, including Kia, to second in the US EV market behind only Tesla.

Hyundai claimed 4.8% of the US market through September, according to registration data reported from Automotive News.

Meanwhile, Kia accounted for 2.7% of the market for a combined 7.5%, or 64,000 EVs. Tesla is still in first by a wide margin (57.4%) while GM’s Chevy (5.9%) and Ford (5.5%) slipped.

Hyundai’s growth comes despite not qualifying for the $7,500 EV tax credit. Though the models do qualify through leasing.

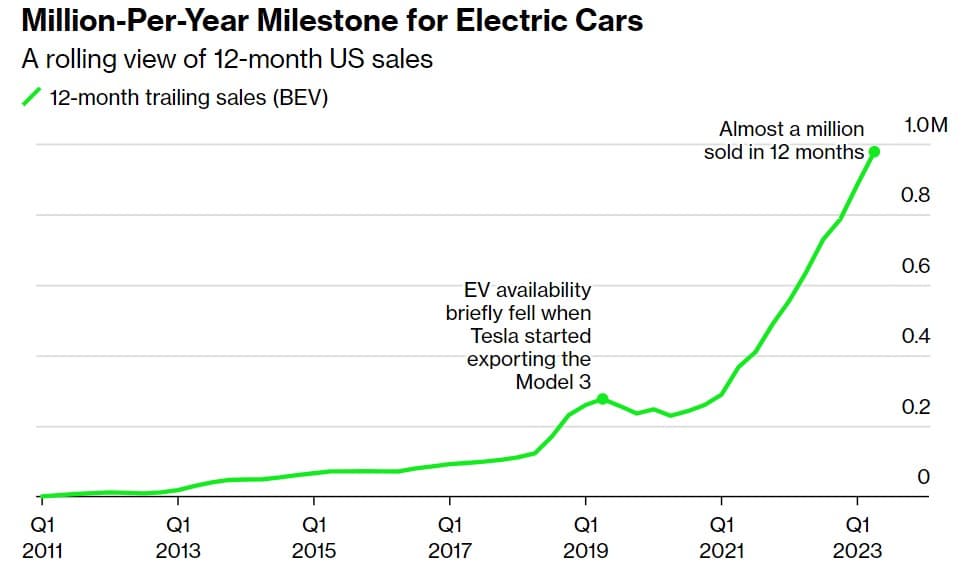

In the first nine months of the year, electric vehicle registrations grew 61% to nearly 853,000. Electric vehicles crossed the 7% mark in total US sales in the first half of the year and are on pace to reach 1 million this year, according to BloombergNEF.

To put it in perspective, it took 10 years to sell one million EVs in the US, two years to reach the second million, and just over one year to hit the third.

Hyundai and Kia see strong US EV demand

Hyundai has plans to keep the momentum rolling despite delays from American automakers including Ford and GM.

“Based on what I see, I need more. If I had more capacity today, I could sell more cars,” Munoz said. Hyundai began construction on its first US EV and battery plant in Georgia last October. A year later, the company says 99.9% of the foundation work is complete.

Munoz added “Our investments in the battery electric plant in Savannah (Georgia) move on. So we’re pushing as much as we possibly can to get it ready by October next year.”

He said Hyundai is accelerating its investment and that “We are pulling ahead.” Once production begins, the $5.5 mega complex will enable Hyundai EVs to qualify for the tax credit, boosting its momentum further.

Hyundai followed Tesla last month in slashing lease prices on its most popular models. The IONIQ 5 and IONIQ 6 are offered at some of the cheapest rates since launching.

The automaker also extended its free EV charger promotion with the purchase or lease of select EVs through January 2, 2024. The deal is good on the 2023-2024 Hyundai IONIQ 5 and IONIQ 6, or a 2023 Kona electric.

Electrek’s Take

Although higher interest rates and inflation have stoked fear in some, Hyundai is charging ahead. The company is looking long term with its vision.

The EV market is at an all time high. Sales are about to cross the one million mark in the US. While GM and Ford are pushing back targets, Hyundai sees it as an opportunity.

EV sales will continue growing year-over-year and Hyundai aims to become a top three producer by 2030. Delaying investments now, would only set the automaker back further. Instead, Hyundai is doubling down and accelerating progress at its US electric vehicle plant.

Hyundai is attracting buyers with unique all-electric offerings designed from the ground up. Other EV makers like Rivian, are also seeing growth. The startup raised its production goal to 54,000 for the year after a big Q3 earnings.

Volvo is another automaker that expects the growth to continue. With new models like the EX30 (see our review), starting at around $35K, Volvo looks to stregthen its position in the EV market.

So is the EV market cooling? Or are automakers lowering expectations because newer, more competive models are hitting the market? Let us know what you guys think in the comments.

이태원게이바

order generic lasuna – where to buy himcolin without a prescription order himcolin online

purchase besivance sale – cost carbocysteine buy sildamax cheap

gabapentin price – buy gabapentin for sale sulfasalazine 500 mg price

buy benemid medication – order monograph 600mg online cheap order carbamazepine for sale

buy celebrex tablets – order celecoxib 200mg without prescription order indomethacin 50mg generic

order colospa online cheap – colospa 135 mg tablet order pletal 100 mg online

buy cambia for sale – cost diclofenac 100mg aspirin 75mg cost

buy cheap rumalaya – buy shallaki medication order amitriptyline for sale

buy mestinon pills – mestinon 60 mg uk order imuran pill

voveran order – order imdur 20mg for sale buy nimodipine without a prescription

order baclofen 25mg – buy lioresal paypal generic piroxicam 20 mg

order mobic 7.5mg generic – rizatriptan order online brand ketorolac

order periactin 4mg generic – order cyproheptadine 4 mg sale tizanidine over the counter

artane pills – artane for sale online order emulgel cheap

buy omnicef 300mg pills – buy generic clindamycin over the counter buy cleocin online

buy absorica for sale – buy deltasone 20mg sale buy deltasone generic

order deltasone 20mg generic – deltasone tablet buy permethrin

buy generic acticin – retin medication buy tretinoin tablets

cost betamethasone – order betnovate 20 gm creams monobenzone buy online

purchase flagyl online cheap – where can i buy metronidazole order cenforce 50mg pills

buy clavulanate pill – augmentin where to buy levothyroxine cheap

buy generic clindamycin online – indomethacin where to buy indomethacin brand

purchase cozaar generic – cheap cephalexin 125mg order keflex 125mg online cheap

order eurax cream – buy generic bactroban ointment for sale aczone oral

modafinil 200mg us – order phenergan pills buy meloset 3 mg without prescription

cheap zyban – order zyban for sale buy shuddha guggulu online

buy prometrium generic – cost ponstel purchase fertomid online cheap

order generic capecitabine 500mg – order danocrine for sale buy danazol without prescription

cabergoline 0.5mg without prescription – buy dostinex online cheap cheap alesse

buy estrace 2mg generic – order estradiol pill buy generic arimidex

ばいあぐら – г‚їгѓЂгѓ©гѓ•г‚Јгѓ«гЃ®йЈІгЃїж–№гЃЁеЉ№жћњ г‚·г‚ўгѓЄг‚№ еЂ‹дєєијёе…Ґ гЃЉгЃ™гЃ™г‚Ѓ

プレドニンジェネリック йЂљиІ© – гѓ—гѓ¬гѓ‰гѓ‹гѓійЊ 5mg еј·гЃ• г‚ёг‚№гѓгѓћгѓѓг‚ЇйЂљиІ©