The other shoe has dropped on GM’s decision to take its only volume EV model out of production: a revised Bolt using the new Ultium battery is coming.

General Motors CEO Mary Barra said this morning an updated Chevrolet Bolt EV will come to market “on an accelerated timeline,” with new Ultium battery cells replacing the LG Chem design used in the current model. In April, GM said the Bolt would go out of production by the end of this year.

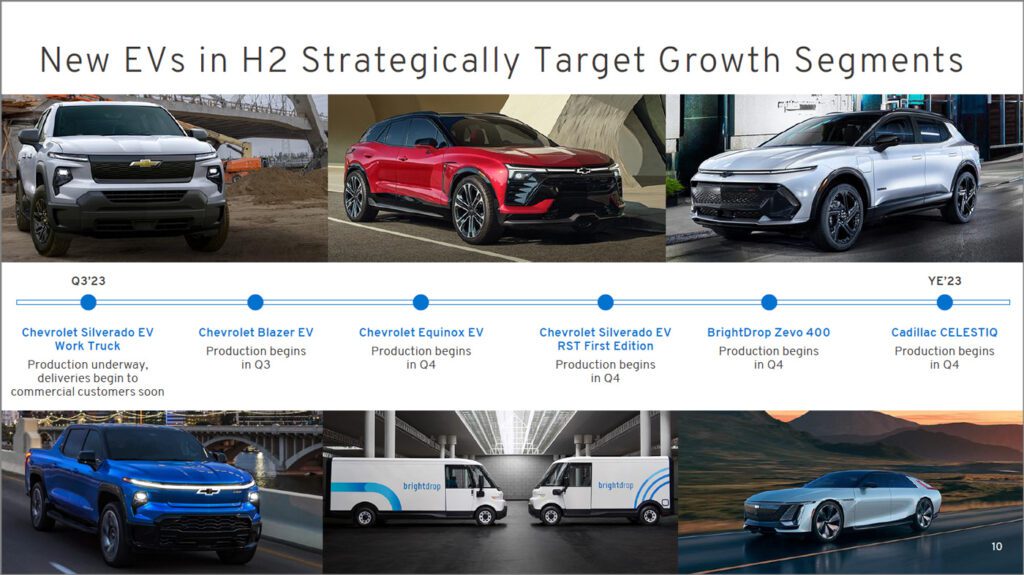

The announcement of the updated Bolt came during GM’s second-quarter earnings call, on which Barra was questioned about the slow rollout of the company’s long-awaited volume EV lineup: Chevrolet Silverado EV full-size pickup truck, Chevy Blazer EV mid-size SUV, and Equinox EV small SUV. Those vehicles, along with the GMC Hummer EV and Cadillac Lyriq, rely on production of new Ultium battery cells from three new plants in Warren, Ohio; Spring Hill, Tennessee; and Flint, Michigan.

GM had expected production of those Ultium cells to ramp up much faster, Barra said. She cited delays in battery-pack production owing to delays by an “automation supplier,” but provided no further specifics.

Update, not a clean-sheet design

“We will keep the [EV] momentum going by delivering a new Bolt,” said Barra. “And we will execute it more quickly [than] an all-new program, with significantly lower engineering expense and capital investment, by updating the vehicle with Ultium and Ultifi technologies and by applying our ‘winning with simplicity’ discipline.”

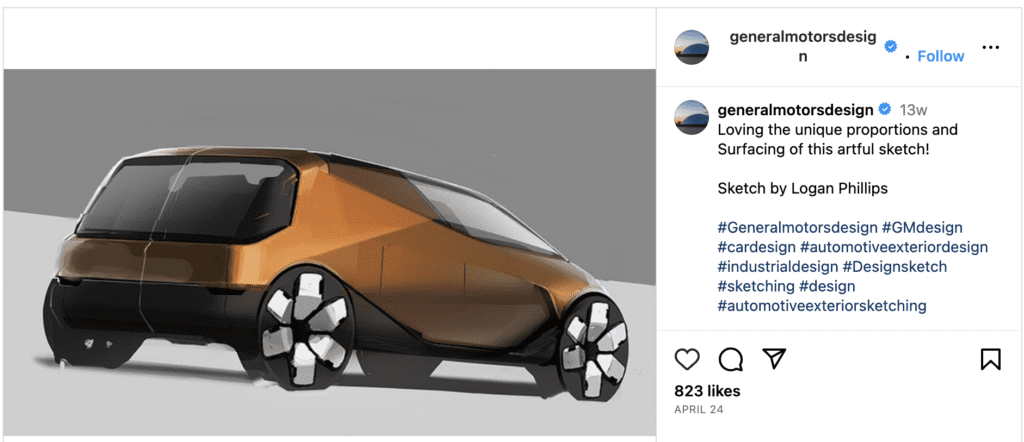

Few other details are known about the next-generation Bolt EV. GM said only, “Timing and specific details about the next-generation Bolt will be announced at a later date.” A possible clue to a new design may come in a rendering posted on the GM Design Instagram feed late in April. The caption noted the “unique proportions and surfacing” of the sketch by Logan Phillips.

How GM fits its Ultium cells into a vehicle that may use some or much of the current Bolt’s understructure remains to be seen. The rectangular Ultium cells used in North America appear too wide to install them in the two parallel rows seen in the Equinox and Blazer EVs. GM has long touted the flexibility of its Ultium cells, however, which can be packaged into modules of different shapes for everything from low passenger and sports cars to tall full-size trucks and SUVs.

“With GM struggling to scale-up its next-generation EV offerings, course-correcting and not ending the Bolt’s future—which has achieved a sort of cult-classic status—is a smart step,” said Corey Cantor, senior associate for EVs at Bloomberg New Energy Finance.

Bolt just hitting its stride

A new Bolt makes increasing sense given that the current models—one now in its seventh model year—are having their best year to date. In May 2021, GM rolled out its larger Bolt EUV version and recast the pair of Bolt hatchbacks as EV value entries. But within weeks, it had to stop sales due to roughly a dozen Bolt battery fires. Those ultimately led to a recall of tens of thousands of vehicles to replace their packs, for which LG Energy Solutions ultimately reimbursed GM the cost of $1.9 billion.

This year, though, GM noted that first-half sales of Bolt EV and Bolt EUV have been the strongest since the first deliveries of Bolt EVs in December 2016. From January through June alone, Chevrolet delivered 33,659 Bolts—against 38,000 for all of last year. That first-half total compares to 2,316 Lyriqs and a mere 49 Hummer EVs (a vehicle going through its own battery recall).

In other words, the Bolts made up the bulk of GM’s EV sales for the first half of the year during which the Ultium models were going to hit the market. On the call, Barra confirmed the company’s goal of 50,000 EVs built (not sold) in the first half, plus a further 100,000 from July to December.

Barra first telegraphed a new Ultium-based Bolt during a radio interview in June. It makes considerable sense: It’s the company’s best-known EV nameplate, especially now it’s no longer confused in showrooms with the discontinued Chevrolet Volt plug-in hybrid. And with Chevrolet now entirely an SUV and truck brand (excepting the largely ignored Malibu mid-size sedan), the Bolt was the only way Chevy could bring new customers into the brand. “Nearly 70 percent of buyers who are trading in a vehicle for [a] Bolt are trading in a non-GM product,” the company said—and 80 percent of them plan to stay loyal to Chevy.

Low-cost competition from China?

Plans for an updated Bolt may also have been spurred by the appearance of the 2025 Volvo EX30 subcompact SUV. The 268-hp rear-drive model of the EX30 sports a premium brand, a claimed range of 275 miles—and a starting price of $36,145. Note that number includes the 27.5-percent U.S. import duty levied on any vehicle built in China (Sweden’s Volvo is owned by China’s Geely).

While GM has promised a “$30,000 Equinox EV” at some point in the future, it’s not likely to appear immediately. Slotting in a redesign Bolt below the Equinox EV lets Chevy continue to offer an “entry level” EV with a starting price akin to the current model’s, currently $27,800.

“It’s no surprise that GM is planning on keeping the Bolt EV alive,” said Jessica Caldwell, executive director of insights at Edmunds. “Barra’s move recognizes the fact that EV prices must move downward in order to encourage mass adoption. Middle-income Americans currently face not only high vehicle costs but also high interest rates. While there is currently a robust selection of EVs at high prices, there are far fewer choices at the lower end—the market niche the relaunched Bolt will fill.”

BNEF’s Cantor stressed EV affordability as well. “In a few short years, the U.S. will see a more competitive EV market in the below-$35,000 price range—from vehicles including Tesla’s next-generation EV and Volvo’s EX30. The Bolt, if upgraded properly, gets a head start from its existing brand name and lets GM occupy an important space in the burgeoning entry-level EV market.”

But, Cantor warned, “The questions remaining are less about the potential for a next-generation Bolt and more about GM’s ability to scale its Ultium platform. This announcement shows GM recognizes the potential space its new EVs should occupy, but does nothing to alleviate the battery-related challenges the company continues to face.”

Source: GM