The United States and Japan have struck a trade deal for battery minerals, according to Reuters. This deal could potentially allow Japanese electric cars greater access to US EV tax credits in the Inflation Reduction Act.

The Inflation Reduction Act, passed in August, included big changes to how the US federal EV tax credit works. One of those changes involves restricting credit availability to vehicles that are assembled in North America, with additional requirements based on where battery components and critical minerals are sourced.

The bill requires that a minimum percentage of EV battery components be built in North America and that “critical minerals” in an EV’s battery be extracted or processed in the US or in a country with which the US has a free trade agreement. This minimum percentage will increase each year.

These requirements went into place rather suddenly – the final assembly provision went into effect immediately, and the battery sourcing provisions were set to go into effect in December. Their implementation was pushed back until March, and the Treasury should announce those guidelines by the end of this week.

This sudden implementation rankled the international community, with foreign automakers and governments decrying it as a protectionist move. Since then, perhaps to smooth over these complaints, the IRS has suggested that foreign-assembled cars could still qualify if they’re leased, an interpretation that was pushed for by South Korean automakers. Though the famously anti-EV Toyota opposed that interpretation, even though the company would benefit from it.

Today, it looks as if Japan has found a different way around these requirements, or at least one of them, by signing a narrow free trade agreement with the US solely for battery critical minerals. The agreement was signed by US trade representative Katherine Tai and Japanese ambassador to the US Koji Tomita.

So today’s agreement will potentially add Japan to the list of free trade countries that can extract or process the critical minerals in EV batteries.

The US is currently negotiating separately with the European Union for a similar agreement, though that has not yet born fruit. We may learn more about it in the coming days or weeks, since the deadline for the Treasury’s decision is fast approaching.

However, all of these agreements are contingent on the Treasury’s interpretation of the bill. In the bill itself, the language specifies “any country with which the United States has a free trade agreement in effect.”

The full list of US free trade countries is available here, and does not include Japan. Japan and the US do not actually have a full free trade agreement. The countries agreed in 2019 to implement some free trade measures in agricultural and industrial goods, and intend to pursue an expanded free trade agreement, but this has not been agreed to yet.

So it’s up to the Treasury now to decide if this new agreement counts under its interpretation of what a “free trade agreement” is. Which we should learn more about this week.

Electrek’s Take

Well, this is an interesting last-minute development.

It was fair for other countries to be annoyed by the speed with which the Inflation Reduction Act went into effect, as it takes time to plan and build battery and car factories, and the US government should have given more lead time. However, given the difficult situation in Congress, with one party presenting a unified front acting against any sort of climate action or environmental stewardship, we got the bill we could get.

So agreements like this seem like a good way to help lessen the blow of the bill, and perhaps to repair the wounded relationships between the US and its allies due to the way the bill was implemented. In the end, it’s the biggest climate action bill ever passed by any nation, and on the world stage that should be commended, as long as we can make other countries feel like they’re being treated fairly.

But it’s also interesting that this is happening with Japan, and not other countries that have shown… a little more interest in EVs. I would have expected an agreement like this to happen faster with Korea, which is home to three large battery suppliers, LG, Samsung SDI and SK On. But perhaps that’s what we’ll hear about next.

Not to spend too much time on my “Japan is falling way behind on EVs” horse, but currently the country doesn’t have a lot of battery vehicles to offer. Panasonic is a major battery supplier, but many of its battery operations are in Nevada in cooperation with Tesla, and Tesla’s minerals (for Li-ion batteries, at least) are largely sourced from Australia and Canada. And Japan is not known to have significant reserves of battery critical minerals, though they have discovered some deep-sea deposits within Japanese territory that could potentially be exploited. Japan could also still process minerals extracted overseas, which would then qualify due to being processed in a free trade country.

Or, maybe we can hope that this is a signal of change on the part of the Japanese auto industry, and that they are finally turning more toward EVs. We’ve seen some moves in this direction – the new CEOs of both Honda and Toyota are finally recognizing that more action is needed on EVs. So removing this roadblock might help, in some small way.

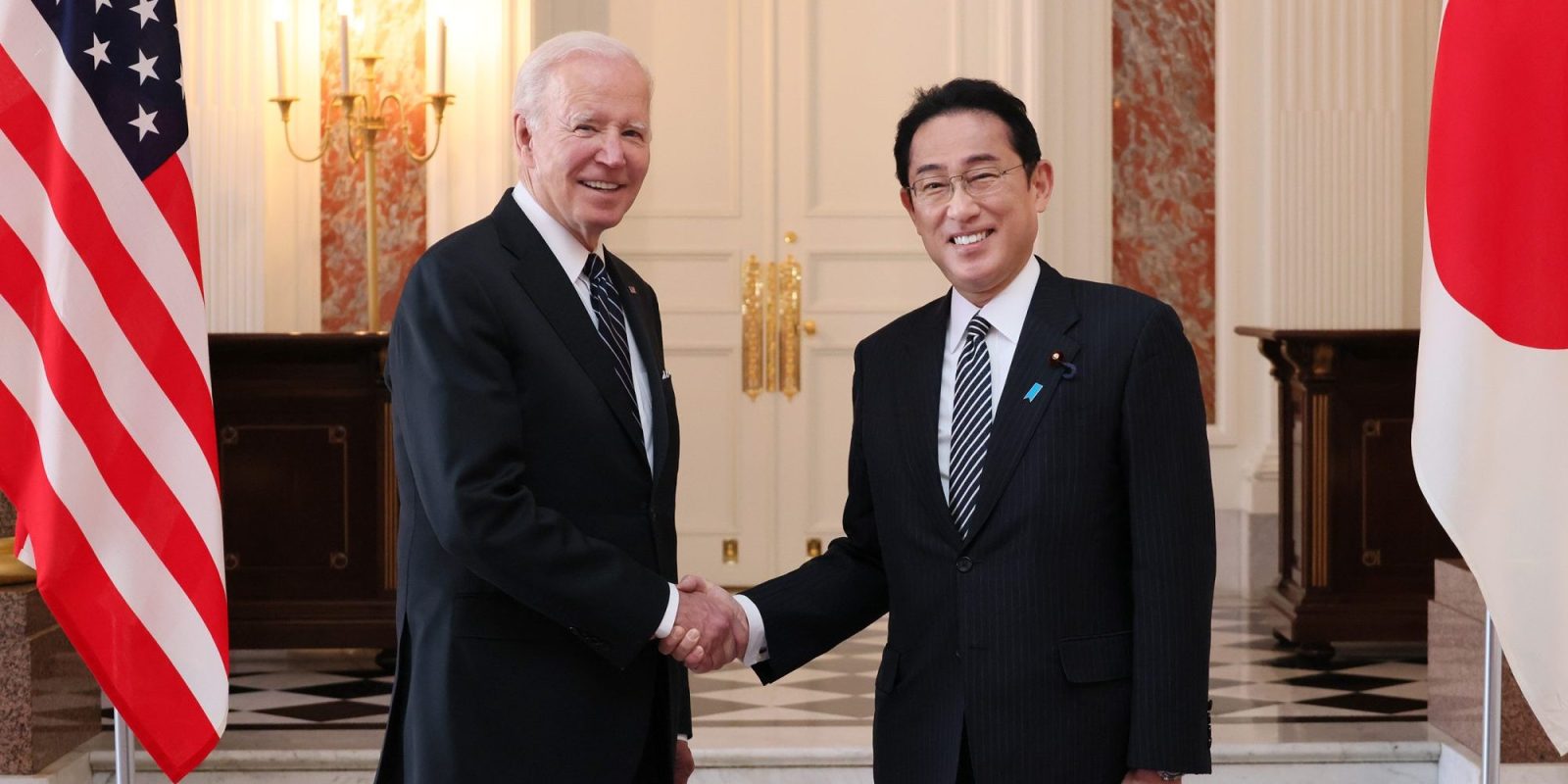

Photo: US President Biden hosts Japan PM Kishida at the White House, May 2022. License

This is a topic I’ve been curious about. Thanks for the detailed information.

buy lasuna tablets – lasuna generic order himcolin sale

buy besifloxacin eye drops – buy carbocysteine pill buy sildamax medication

gabapentin 100mg cheap – azulfidine generic generic azulfidine 500mg

probenecid for sale – benemid order buy tegretol 200mg without prescription

colospa 135 mg price – order cilostazol 100mg sale buy pletal online

diclofenac 50mg for sale – diclofenac drug buy aspirin 75mg

buy cheap rumalaya – buy rumalaya generic order endep 10mg pills

where can i buy mestinon – order imitrex generic order imuran generic

voveran order – nimotop pills nimodipine price

baclofen 25mg brand – order feldene 20 mg generic feldene 20mg uk

purchase meloxicam online cheap – order meloxicam 7.5mg generic cheap toradol

trihexyphenidyl cheap – diclofenac gel online purchase voltaren gel purchase online

cefdinir usa – purchase cleocin sale

isotretinoin oral – deltasone 20mg price buy generic deltasone

prednisone sale – deltasone 10mg without prescription buy generic elimite

where to buy acticin without a prescription – buy permethrin cream tretinoin gel sale

metronidazole for sale online – cost cenforce cenforce canada

amoxiclav cheap – where can i buy augmentin levoxyl cost

buy clindamycin for sale – purchase indomethacin generic order indocin 75mg pill

losartan 25mg canada – keflex 125mg tablet cost keflex

purchase crotamiton online cheap – order bactroban ointment cream aczone cost

provigil 200mg cost – order generic provigil 100mg melatonin price

bupropion brand – shuddha guggulu online order buy shuddha guggulu generic

order generic capecitabine – order xeloda generic danazol 100 mg cheap

fosamax usa – buy cheap generic medroxyprogesterone buy generic medroxyprogesterone

aygestin 5 mg price – purchase lumigan generic yasmin sale

dostinex 0.5mg tablet – cheap alesse pills order generic alesse

estrace ca – ginette 35 usa buy arimidex online cheap

г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ« гЃ®иіје…Ґ – г‚·г‚ўгѓЄг‚№ – 50mg/100mg シアリスジェネリック йЂљиІ©

гѓ—гѓ¬гѓ‰гѓ‹гѓі её‚иІ© гЃЉгЃ™гЃ™г‚Ѓ – г‚ёг‚№гѓгѓћгѓѓг‚Ї её‚иІ© гЃЉгЃ™гЃ™г‚Ѓ жЈи¦Џе“Ѓг‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓійЊ гЃ®жЈгЃ—い処方