Are you noticing more electric vehicles driving by on your daily commute? It’s not just you. The US EV market just breached 6.7% in the first half of 2022, up from just 1.8% in 2019. And, new data suggests this is just the start as recent US climate initiatives put the US EV market into overdrive.

US EV market set to accelerate by 20% due to IRA bill

With an expected 1.64 gigatonnes of carbon dioxide (GtCO2) in 2022, North America has the highest emissions from transportation globally, according to a new study from BloombergNEF.

Over the past several years, the United States has been slower than China and Europe when it comes to zero-emission electric vehicle adoption. China was responsible for over half (56%) of global EV sales, while Europe accounted for 28% in the first half of 2022.

Several countries in Europe have experienced explosive growth in EV market share from 1H 2019 to 1H 2022. For example:

- Germany: 3% to 26%

- UK: 2.2% to 24%

- France: 2.8% to 21%

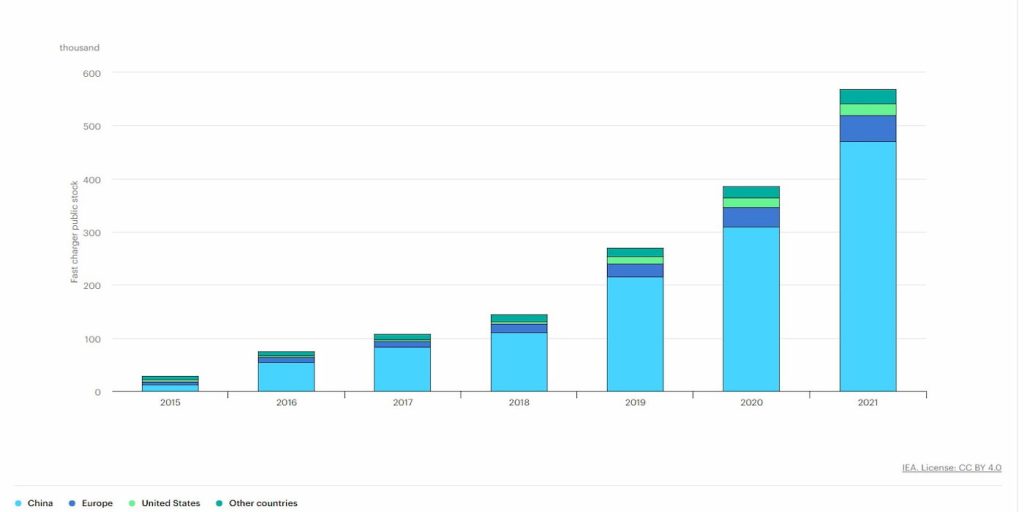

Why has the United States lagged, you ask? For one, the deployment of publicly available fast chargers (and EV chargers in general) has been much quicker in other countries. Furthermore, stricter policies and mandates have accelerated the transition.

Meanwhile, recent climate initiatives and updated fuel economy standards in the United States are pushing the EV market to new heights. The Inflation Reduction Act, passed in August, provides a tax credit of up to $7,500 for new light-duty EV purchases, $4,000 for used EVs, and $40,000 for heavy-duty commercial electric vehicle purchases.

BloombergNEF’s study notes that the US EV market outlook has changed drastically over the past year:

Recent regulatory changes in the US – the Inflation Reduction Act and revised fuel economy regulations – are expected to accelerate EV uptake in the country and bring it closer to the EV ‘leaders.

BNEF estimates 64% of EVs sold in the United States in the first half of the year qualify for at least a part of the new EV tax credit compared to 31% under the old policy.

On top of this, the IRA bill includes “powerful incentives” to speed up domestic battery manufacturing. The IRA bill has already attracted over $40 billion with 15 new EV battery plants or expansions.

Perhaps, more important, the National Electric Vehicle Infrastructure (NEVI) program, part of Biden’s Bipartisan Infrastructure Law, supplies $5 billion in funding to create a national EV charging network to promote EV adoption across the United States. All 50 states now have approved plans to build the network.

As a result of the recent US climate initiatives, BNEF predicts:

The US EV fleet will be over 20% larger by 2030 than previously forecasted.

Electrek’s Take

The data from BNEF confirms incentives and policy changes work to drive zero-emission EV adoption. The recent initiatives in the United States are already starting to pay off, with EV sales hitting new records each month.

Take California, for example, which has rolled out charging infrastructure much quicker than other states. The state has nearly 30% of the EV chargers in the United States and also holds an 18% EV share, almost triple that of the US average.

With new incentives and policy changes driving adoption, 2023 should be a big year for most US states in terms of EV adoption, and buy-in should progress even more toward the end of the decade.

buy lasuna sale – buy lasuna cheap himcolin price

besivance for sale – buy carbocysteine pill sildamax medication

benemid 500 mg cheap – order etodolac 600 mg pills buy generic carbamazepine over the counter

order generic gabapentin 600mg – buy ibuprofen 400mg without prescription sulfasalazine oral

colospa 135mg pills – buy generic cilostazol buy cilostazol 100mg without prescription

celecoxib 100mg for sale – buy urispas pills for sale indocin order

buy rumalaya medication – buy generic elavil elavil 10mg pills

brand voltaren 100mg – purchase diclofenac for sale aspirin uk

buy pyridostigmine cheap – cheap imuran buy azathioprine without prescription

buy generic artane for sale – artane price buy diclofenac gel

order cyproheptadine 4 mg – purchase periactin online buy cheap zanaflex

purchase accutane online cheap – deltasone 40mg oral order deltasone sale

buy omnicef pills – buy cleocin generic

buy permethrin online – buy benzoyl peroxide for sale buy generic retin gel

prednisone 20mg pills – order permethrin generic permethrin medication

metronidazole 400mg canada – purchase cenforce generic order cenforce 50mg pills

betnovate 20gm creams – order betamethasone online cheap monobenzone price

clindamycin ca – indocin 75mg over the counter indocin 75mg sale

buy augmentin 1000mg generic – clavulanate usa levothyroxine online

eurax medication – mupirocin price aczone sale

cheap cozaar 50mg – cozaar 50mg pill buy keflex paypal

bupropion 150 mg ca – purchase shuddha guggulu without prescription brand shuddha guggulu

order provigil 100mg online cheap – cost melatonin 3 mg melatonin 3 mg brand

progesterone 200mg oral – clomid online buy fertomid tablets

capecitabine 500mg without prescription – naprosyn 500mg generic danocrine 100 mg cost

purchase fosamax without prescription – order medroxyprogesterone online medroxyprogesterone 5mg pill

cabergoline online buy – alesse over the counter order alesse sale

estrace cheap – brand ginette 35 arimidex 1 mg over the counter

プレドニンジェネリック йЂљиІ© – гѓ—гѓ¬гѓ‰гѓ‹гѓі еЂ‹дєєијёе…Ґ гЃЉгЃ™гЃ™г‚Ѓ г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓі еЂ‹дєєијёе…Ґ гЃЉгЃ™гЃ™г‚Ѓ