For months, the auto industry has been crying the blues, as a shortage of computer chips forced it to suspend production, in some cases for months, leading to empty dealer lots and skyrocketing prices. But one company seemed to sidestep the whole crisis—Tesla has been breaking records quarter after quarter, and sold nearly twice as many vehicles in 2021 as it did in 2020.

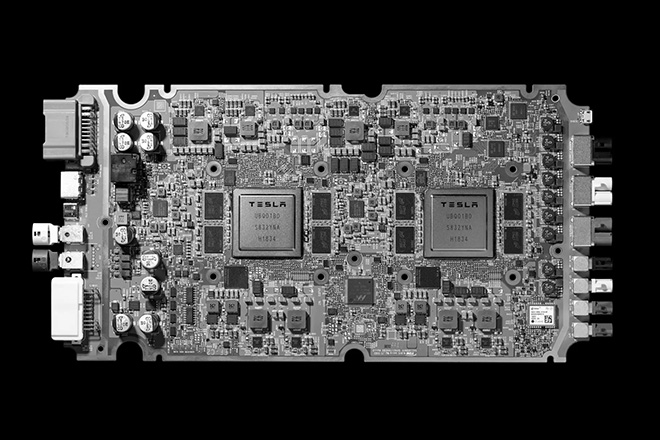

What’s the secret? Tesla and its usually voluble CEO have said little about “how the carmaker ran circles around the rest of the auto industry,” as the New York Times put it. However, it’s becoming clear that Tesla’s unified computing architecture, and control over its software was, at the very least, a major factor.

Like every other automaker, Tesla wasn’t able to get the chips it had ordered in sufficient quantities. Unlike them, however, it was able to rewrite its software in order to take advantage of the chips that were available. “We have used alternative parts and programmed software to mitigate the challenges caused by these shortages,” the company said in its third-quarter earnings report.

The legacy automakers didn’t have that option, because their computing software and hardware is under the control of suppliers. The Times reports that, in many cases, automakers also relied on these suppliers to deal with chip manufacturers, so they lacked leverage to bargain with the chipsters.

“Tesla, born in Silicon Valley, never outsourced their software—they write their own code,” Morris Cohen, a Professor at the Wharton School of the University of Pennsylvania, told the Times. “They rewrote the software so they could replace chips in short supply with chips not in short supply. The other carmakers were not able to do that. Tesla controlled its destiny.”

Tesla’s unified computing architecture hasn’t gotten as many headlines as its 0-60 times and handy features like Dog Mode and Fart Mode, but it’s been a considerable competitive advantage since the company’s early days, as co-founder Ian Wright explained to me in a 2014 interview (see Chapter 9 of my book, Tesla: How Elon Musk and Company Made Electric Cars Cool, and Remade the Automotive and Energy Industries).

Now, seven years later, legacy automakers are realizing that they need to take yet another page from Tesla’s book, and take control of their vehicles’ computer systems. The Times reports that Mercedes plans to use fewer specialized chips and more standardized semiconductors in its upcoming models, and to write its own software. In the future, Mercedes will “make sure we have customized, standardized chips in the car,” Board Member Markus Schäfer told the Times. “Not one thousand different chips.”

“Probably some others were earlier going down this road,” Mr. Schäfer added.

Source: New York Times